Over the previous 10 years, the worldwide vitality transition away from coal has accelerated. The variety of nations with coal energy below growth (pre-construction and development) has almost halved from 75 in 2014 to simply 40 in 2024.

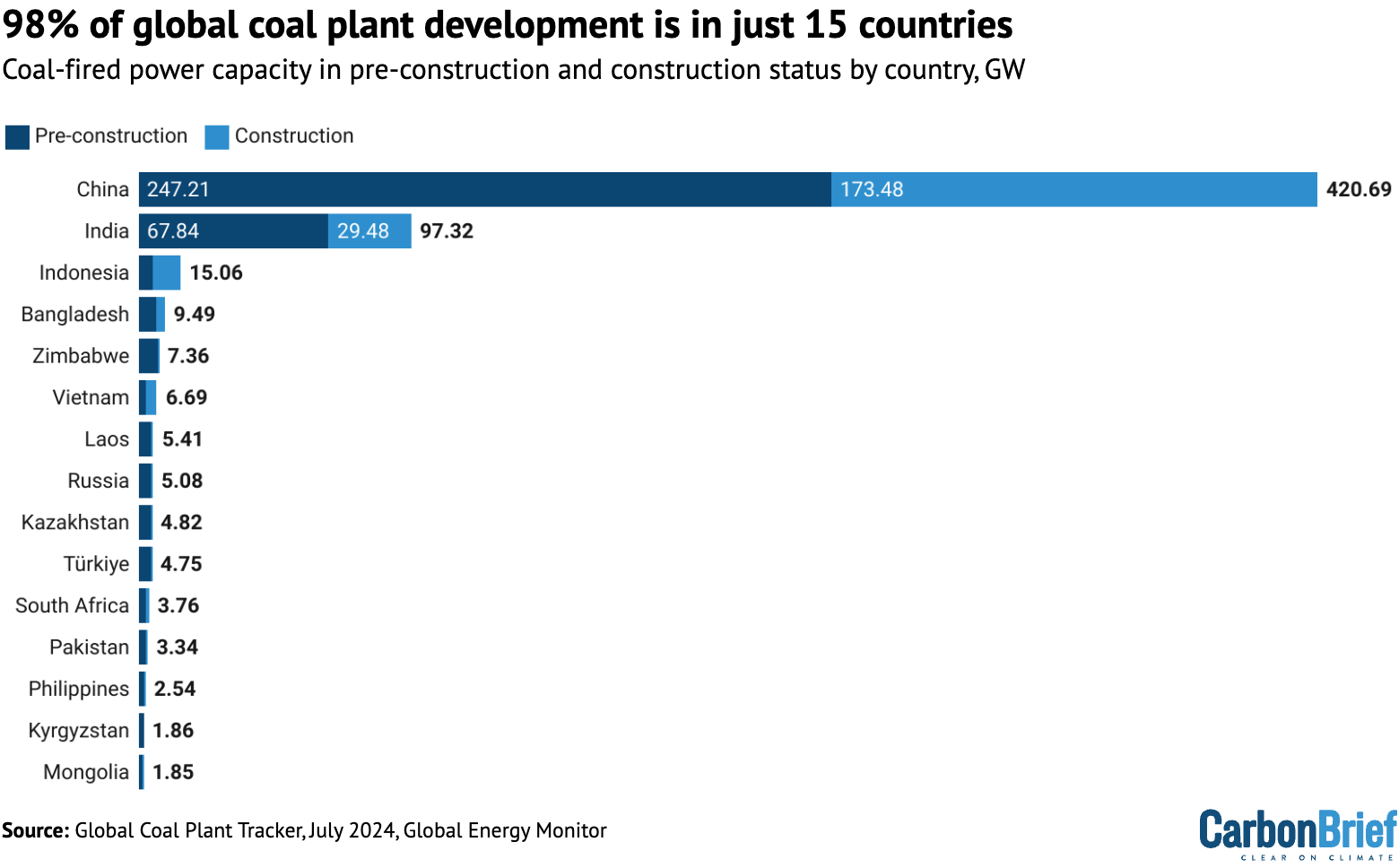

As well as, almost the entire coal-power capability below growth (98%) is now concentrated in simply 15 nations, with China and India alone accounting for 86%.

That is in line with World Vitality Monitor’s newest World Coal Plant Tracker (GCPT) outcomes, accomplished in July 2024. The GCPT catalogues all coal-fired energy models 30 megawatts (MW) or bigger biannually, with the primary survey courting again to 2014.

Regardless of the focus of coal-plant growth in fewer nations and projections that international coal demand might be peaking, new coal-fired energy station proposals proceed to outpace cancellations.

Within the first half of 2024, over 60 gigawatts (GW) of coal capability was newly proposed or revived, in comparison with the 33.7GW that was shelved or cancelled over the identical interval.

This text particulars among the most important tendencies driving the continued growth of coal throughout the 15 largest markets, drawing perception from the GCPT, in addition to wider context.

World overview

Over the primary six months of 2024, almost twice as a lot coal capability was proposed as was shelved or cancelled, as coal-fired capability continues to develop globally.

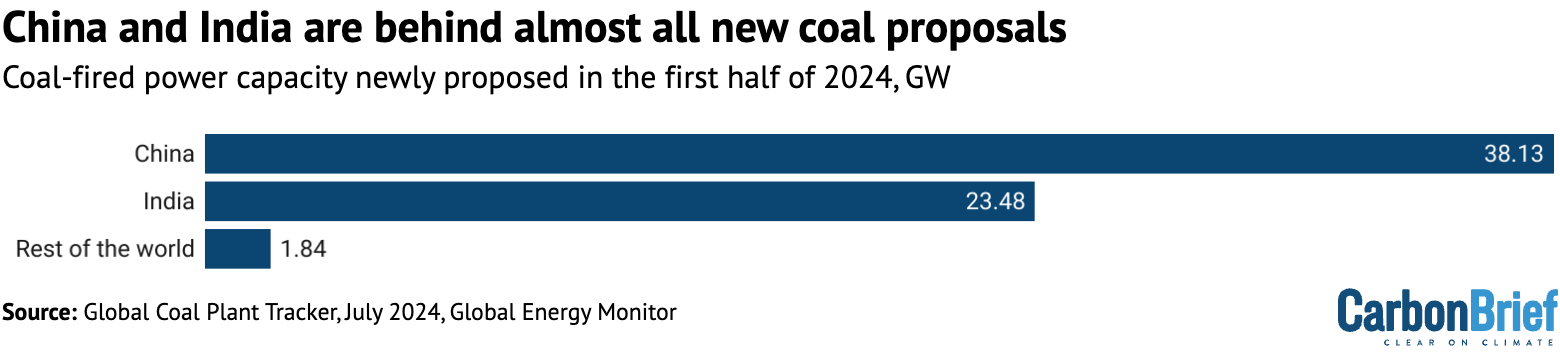

This rebound in proposals is essentially as a result of a resurgence starting in China in 2022, adopted by India in 2024. In actual fact, as proven within the determine under, virtually all (97%) of the brand new and newly revived proposals within the first half of 2024 are situated in China and India.

Moreover, of the 1.8GW of newly proposed capability in the remainder of the world, greater than 40% is sponsored by Chinese language firms.

Our outcomes present that the elimination of recent coal crops – an important step towards the fast discount in coal energy use wanted to maintain international warming under 1.5C – is more and more depending on a shrinking variety of nations.

The signing of the Paris Settlement in 2015 kick-started momentum within the international shift away from coal. So far, 75 nations have established carbon neutrality targets for 2050 or earlier, and over 100 nations are coal-free or have a longtime coal phaseout date in 2040 or earlier.

This rising variety of commitments has been accompanied by a steep drop in coal capability below growth globally – the quantity that has been introduced, entered the allowing course of, been granted a allow or began development.

This pipeline of coal below growth has declined by 62% in comparison with a decade in the past, from 1,576GW in 2014 to 604GW as we speak, in line with the newest knowledge from the GCPT

As proven in determine under, 590GW of that 604GW is concentrated in a handful of nations, dominated by China (70%) and India (16%). The opposite 14GW (not proven under), or 2% of the entire capability, is unfold throughout 25 nations, every with lower than 1.5GW below growth.

Regardless of the decline, some nations haven’t but set vitality transition targets in keeping with the Paris Settlement or the UN’s 2023 “acceleration agenda”, which requires the termination of all remaining coal proposals and a complete phaseout of coal energy by 2040.

The primary international stocktake, drafted on the December 2023 COP28 convention, “urges” the same however much less aggressive international “phase-down of unabated coal energy”.

At present, although, not one of the fifteen nations main continued coal plant growth have a longtime coal phaseout goal.

Whereas Indonesia, Vietnam and South Africa have negotiated “simply vitality transition partnership” (JETP) agreements to transition away from coal, their plans nonetheless permit for some development in coal energy.

The JETP agreements have additionally but to resolve a number of thorny points, equivalent to easy methods to deal with “captive” coal crops that provide electrical energy off-grid, sometimes to giant industrial websites. Elevated JETP ambitions may assist these nations obtain Paris-aligned emissions reductions.

China is concerned in coal growth in Indonesia, Zimbabwe, Laos, Kyrgyzstan and Mongolia, together with some capability proposed after China’s 2021 pledge to cease constructing new coal crops overseas. Obvious exceptions to the 2021 moratorium have emerged for initiatives designed for captive use or proposed as expansions at present China-backed initiatives.

In the meantime, many new coal proposals in Kazakhstan and Kyrgyzstan have Russian backing.

A number of nations, together with Bangladesh, Pakistan, the Philippines and Turkey are persevering with with plans to develop a backlog of proposed coal crops within the face of counteraction to the gasoline, equivalent to native opposition, coverage adjustments, finance moratoriums and different challenges.

The newest developments in every of those 15 nations are detailed under. The nations are listed so as, beginning with the most important capability of recent coal below growth, in China. Every features a map that gives a snapshot of the coal-fired energy crops below growth, for the complete knowledge behind every see the GCPT database.

China

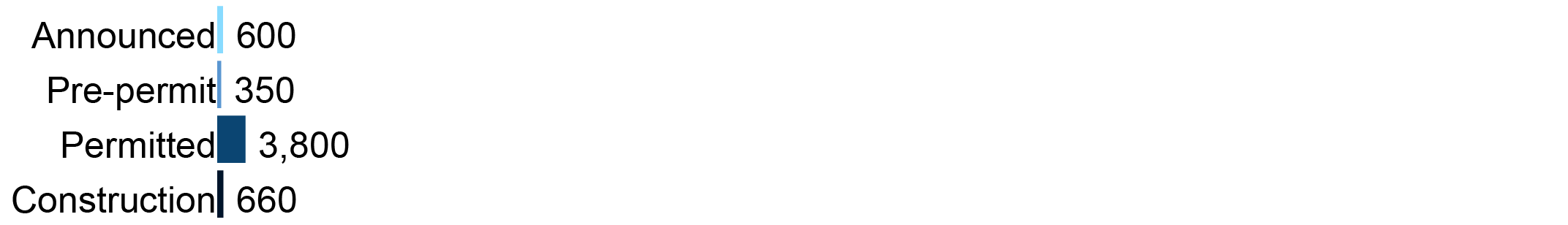

Whole deliberate capability, GW

China’s dominance within the international vitality panorama is underscored by its monumental coal energy capability.

As of June 2024, the nation had 1,147GW of operational coal capability unfold throughout almost 3,200 models, representing greater than half (54%) of the world’s whole working coal capability.

For years, China has led coal energy growth, however the tempo of this growth confirmed notable indicators of an incoming slowdown within the first half 2024.

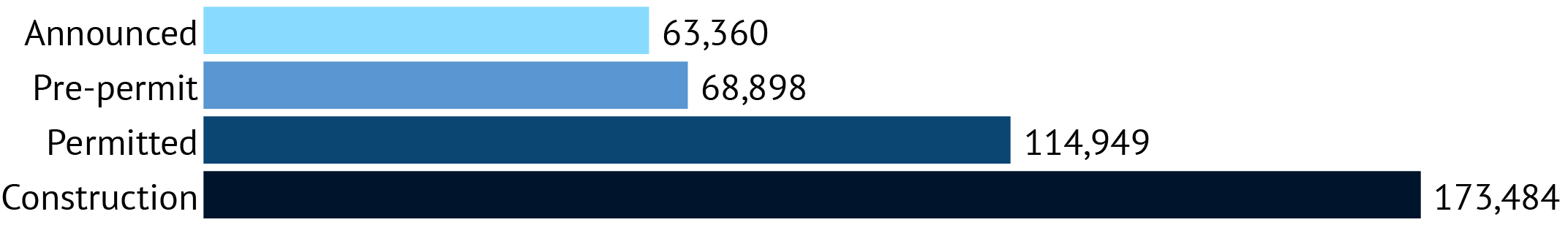

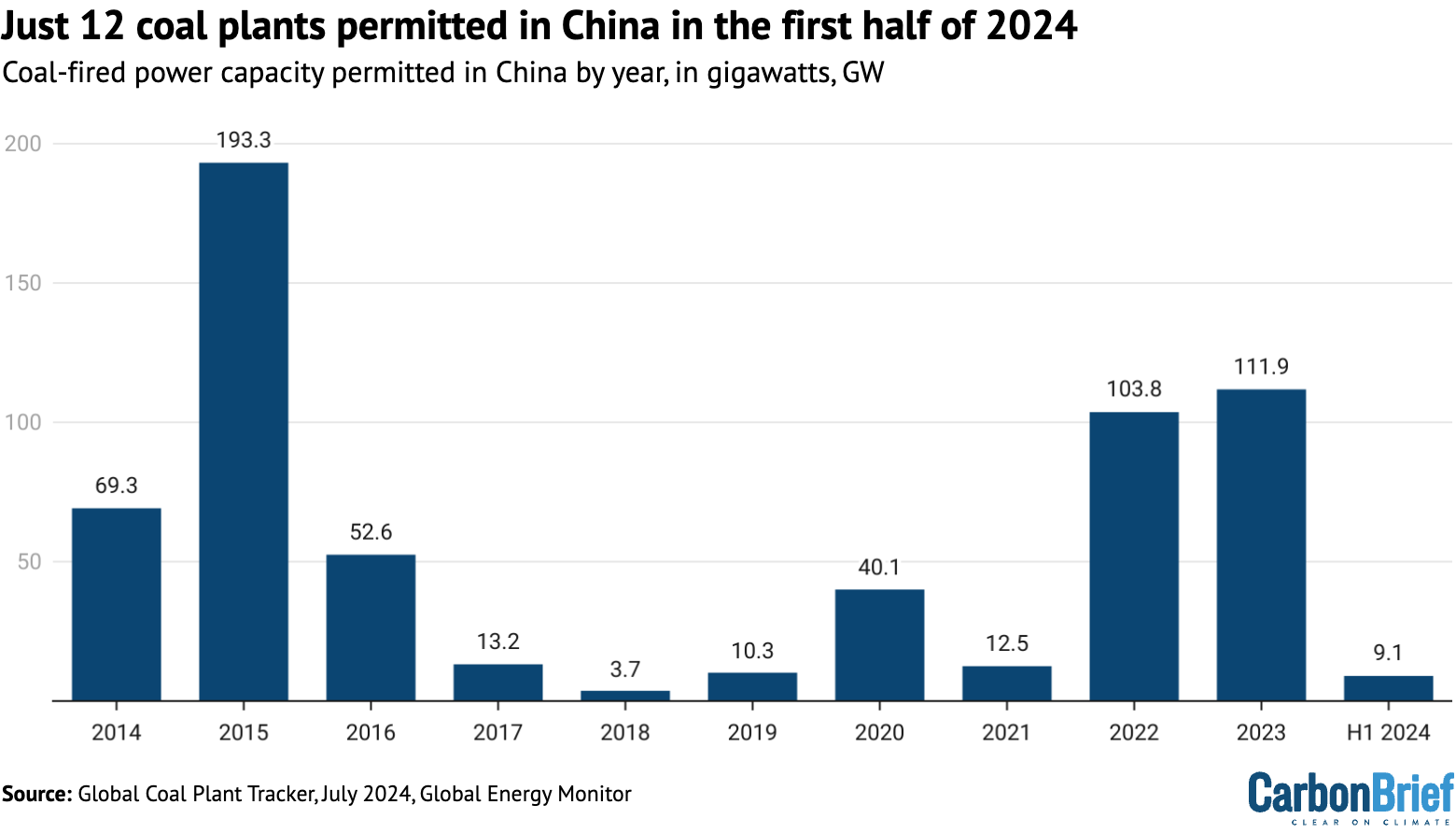

Following the latest spate of allowing of coal initiatives, exceeding 100GW yearly in 2022 and 2023, China has made a sudden pivot.

The nation drastically lowered approvals for brand new coal energy within the first half of 2024, granting permission to solely twelve initiatives totaling 9.1GW, as proven within the determine under.

The newly permitted capability is equal to simply 8% of what was permitted in all of 2023 and 17% of the height half-year capability permitted within the second half of 2022.

Notably, a few of these permitted initiatives had been expedited. For instance, the extension of the Harbin No. 3 energy station was initiated in April 2024 after which permitted for development simply two months later.

In 2024, proposals for brand new and revived coal initiatives are additionally exhibiting a downward development in comparison with the height years of 2022 and 2023, with 38.1GW of recent and revived proposals within the first half of the 12 months, in comparison with 60.2GW within the first half of 2023 and 47.8GW within the first half of 2022.

This development hints at a possible slowdown in new venture growth, albeit not as pronounced because the allow slowdown.

GEM’s evaluation signifies that the deceleration of coal venture bulletins and allowing is probably going the results of China’s large clear vitality deployment. By the top of June 2024, the entire grid-connected wind and photo voltaic capability reached 1,180GW, making up 38.4% of the entire put in energy era capability within the nation and overtaking coal (38.1%) for the primary time in historical past.

In 2024, renewable energy development was evenly balanced towards electrical energy demand development, in line with the China Electrical energy Council (CEC). As such, coal is starting to shift right into a supporting position, GEM evaluation suggests.

Regardless of the slowdown in allowing, there may be nonetheless a considerable overhang of recent coal capability permitted throughout 2022 and 2023.

Certainly, development actions within the first half of 2024 had been sturdy, with over 41GW of initiatives initiated, almost matching the 2022 full-year whole. As well as, over 8.6GW of coal energy entered operation within the first half of 2024.

Furthermore, the Chinese language authorities has a goal of commissioning 80GW of coal capability in 2024, suggesting a possible surge within the second half of the 12 months.

If even half of that capability is commissioned in 2024, it could be a transparent indication of the coal business’s resilience and momentum regardless of the reducing want for brand new coal energy, our analysis suggests.

Coal plant retirements in China stay low, with just one.1GW of coal capability taken offline within the first half of 2024. From 2021 to 2024, China retired 9.8GW of coal capability and mothballed 2.5GW, not together with capability at models smaller than 30MW.

China should take away 17.7GW of capability from its coal energy fleet within the subsequent 18 months if it desires to fulfil its promise to shut down 30GW of coal energy through the 14th ‘5 12 months plan’ interval.

India

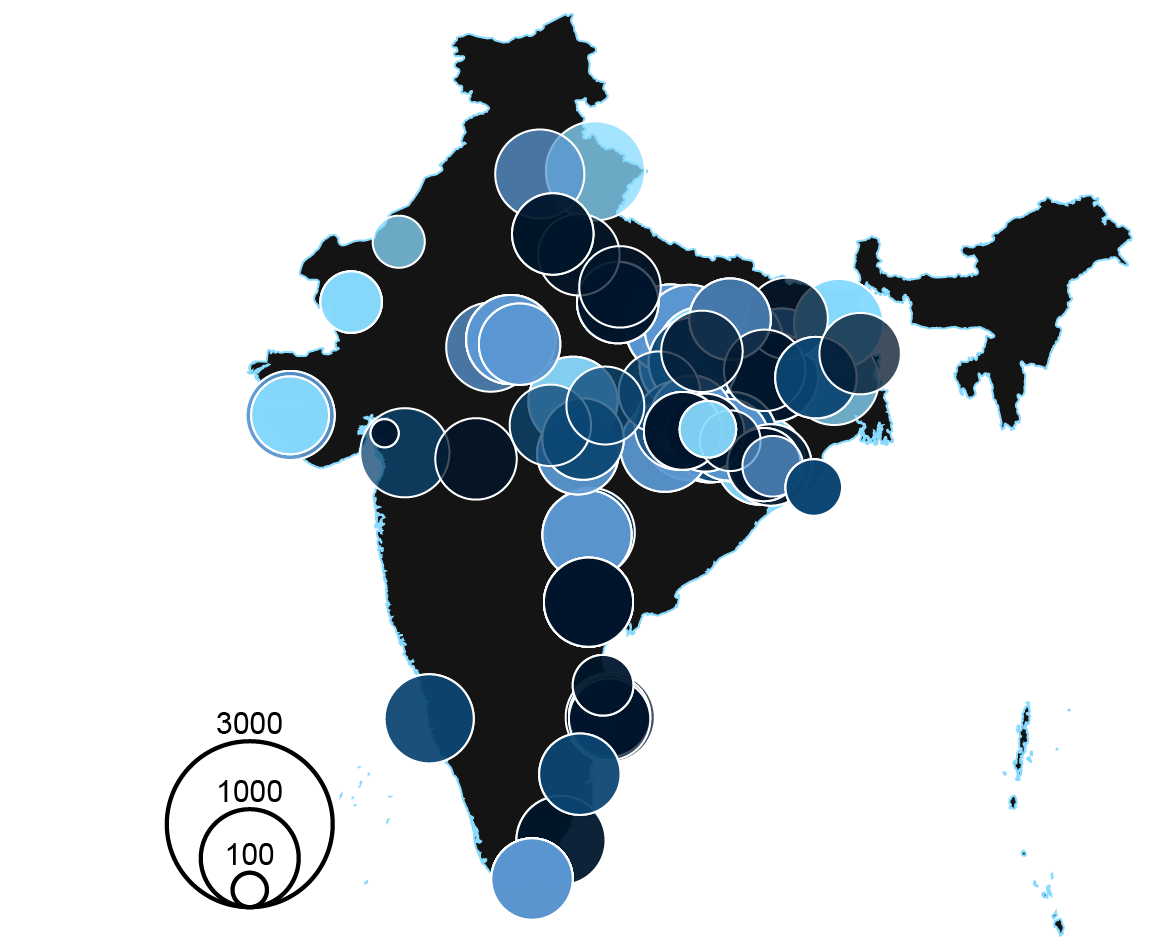

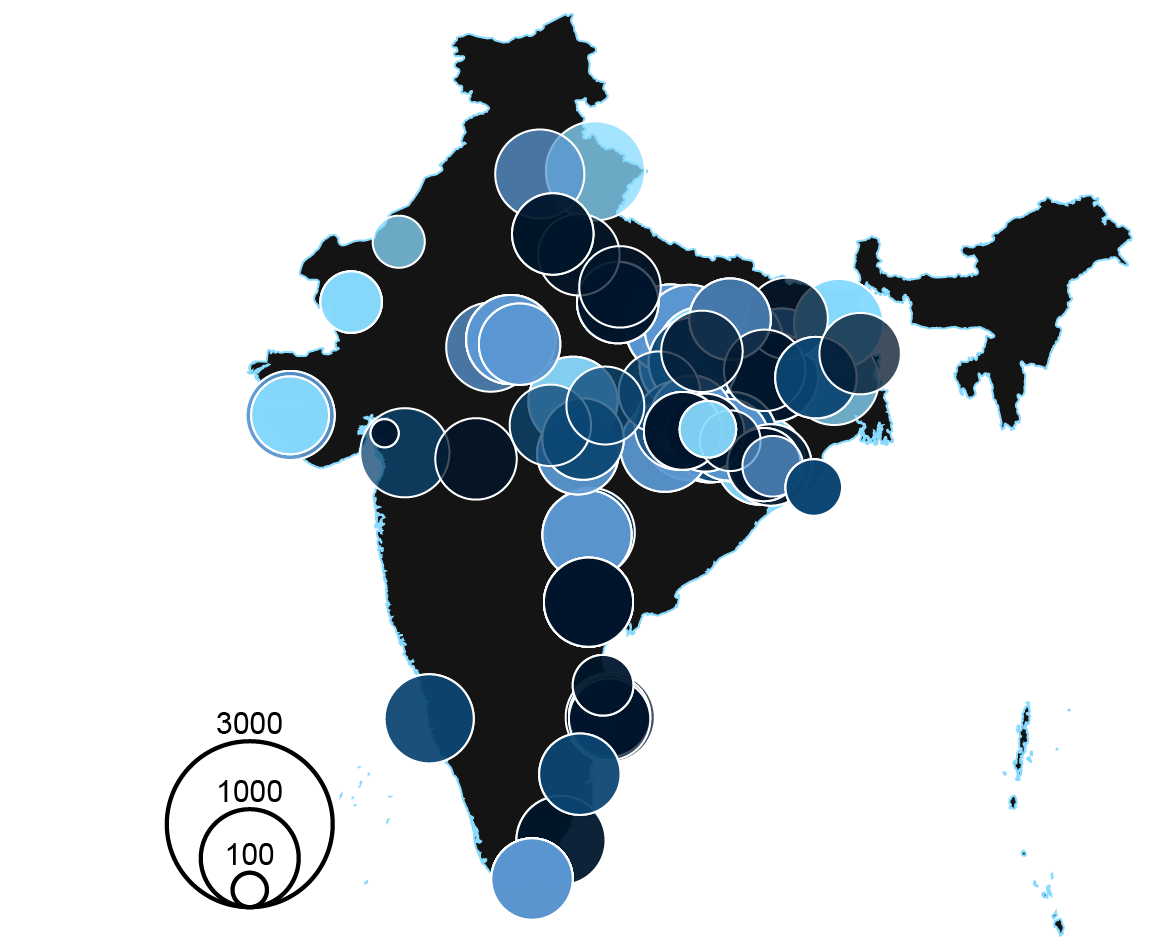

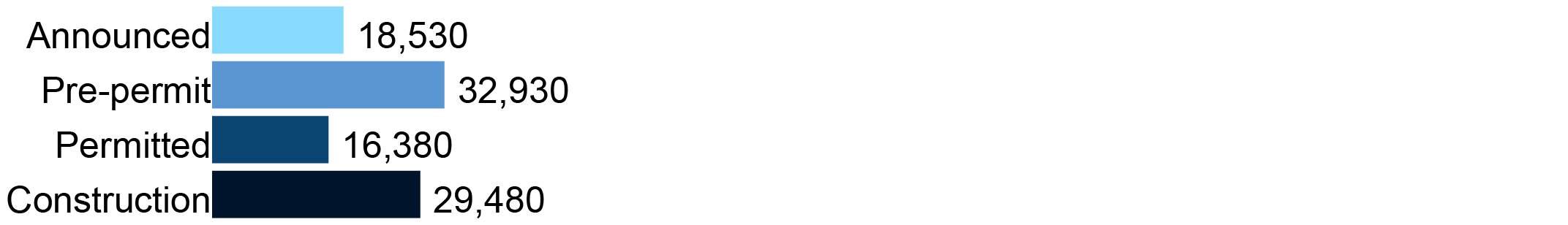

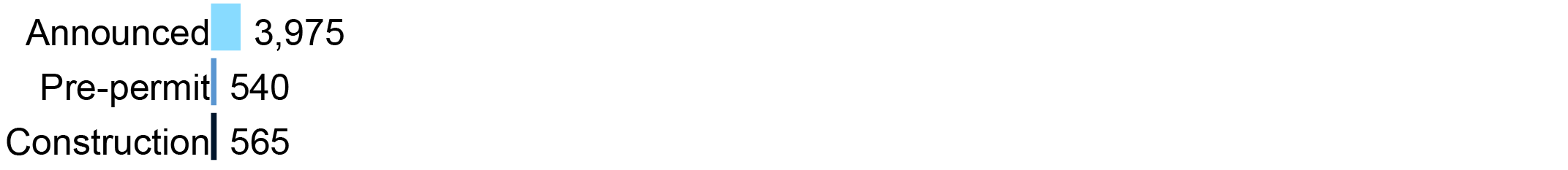

Whole deliberate capability, GW

India’s coal fleet is the second largest on the earth after China, totaling 239.6GW, in line with the GCPT.

Whereas the nation’s electrical energy combine continues to be dominated by coal, renewable vitality additions just lately pushed coal under 50% of put in capability for the primary time.

On the similar time, the event of recent coal plant proposals has proven no signal of slowing down, the GCPT exhibits. On the contrary, India’s coal plant growth ballooned within the first half of 2024.

More and more extreme climate-forced heatwaves proceed to drive up electrical energy demand in India, most just lately culminating in a brand new peak energy demand of 246GW, reached in Could 2024.

Each coal energy era and carbon dioxide (CO2) emissions within the energy sector noticed a ten% enhance from January 2023 to January 2024.

Citing the elevated energy demand, the Indian authorities has inspired and fast-tracked the event of enormous coal crops by predominantly publicly-financed, state-owned entities – regardless of analyses exhibiting that India may meet its rising demand by attaining its renewable vitality targets.

Within the first half of 2024 alone, the capability of recent and revived coal plant proposals (23.5GW) has already surpassed all of 2023 (13.6GW). This elevated the entire coal capability below growth from 76.7GW in 2023 to 97.3GW within the first half of 2024, as proven within the determine under.

In actual fact, newly proposed coal capability in simply the primary half of 2024 is bigger than every other full 12 months’s whole capability of recent proposals in India since not less than 2014, when the GCPT started knowledge assortment.

Many of those proposals are giant growth initiatives opposed by the native inhabitants as a result of displacement and air pollution impacts.

One such venture is the proposed Kawai energy station growth, introduced in early 2024, which might add a considerable 3.2GW to the present 1.3GW plant. At one other, the controversial Mahan Tremendous Thermal energy venture – whose growth affected the livelihood of an estimated 14,000 individuals – Indian multinational Adani Energy has begun development on two growth models, and the Indian authorities has given preliminary approval for 2 further models.

India is now catching as much as China with new coal capability proposals, the nation lengthy thought of to be the remoted international chief in continued coal plant growth. Within the first half of 2024, India’s 23.5GW of newly proposed coal capability was almost two-thirds that of China (38.1GW), in comparison with simply 7% in 2021.

With prime minister Narendra Modi securing his third time period in India’s early 2024 election, ongoing growth of coal and opposition to growing a long-term coal phaseout plan are prone to persist. Whereas India’s coal plant growth surges, the retirement of ageing and inefficient coal crops in India stays close to zero.

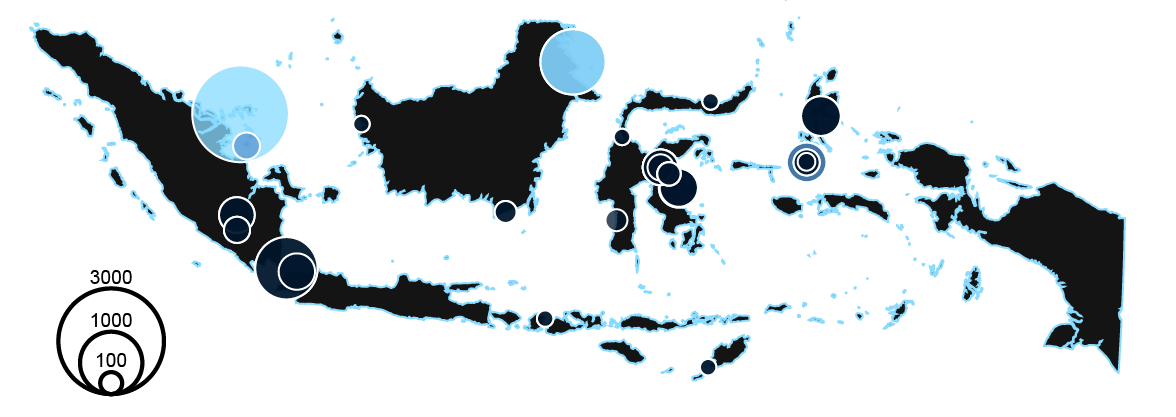

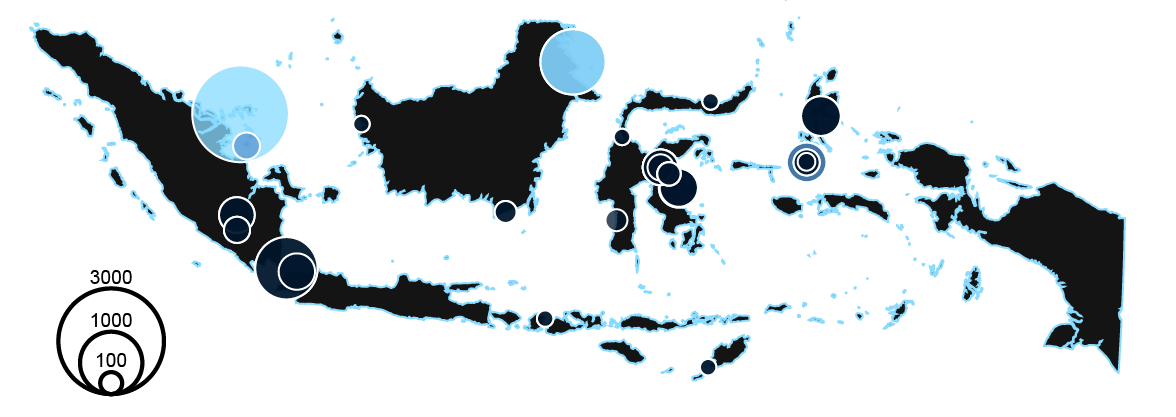

Indonesia

Whole deliberate capability, GW

Indonesia continues to be the largest coal exporter on the earth, and the nation plans to enhance coal manufacturing and consumption in 2024 and past.

Indonesia’s coal capability below growth has diminished by over 70% within the final decade, down to fifteen.1GW from 55.9GW in pre-construction or development in 2014.

Nonetheless, along with having the third-largest coal capability below growth globally, Indonesia faces a number of distinctive challenges to a profitable transition away from coal.

Indonesia’s JETP settlement, which is designed to assist the nation in prioritising various sources of vitality, has confronted surprising challenges within the first half of 2024.

This follows the December 2023 omission of captive coal crops from emissions projections for the JETP complete funding and coverage plan.

Indonesia’s important captive coal-fired capability, each working and below growth, may lock the nation – and its booming steel processing sector – into long-term coal use.

Over 1GW of coal-fired capability entered development within the first half of 2024, and over 40 whole models are actually below development within the nation, in line with the GCPT. Further captive coal capability continued to be proposed in Indonesia in 2024, regardless of rising worldwide opposition to the development.

This opposition is especially seen when the electrical energy is slated to be used in ostensibly “inexperienced” manufacturing initiatives, equivalent to Adaro’s proposed aluminium processing facility in North Kalimantan, Indonesia and the expansive Weda Bay nickel processing facility in North Maluku, Indonesia.

There may be resistance to proposals such because the Xinyi Group captive energy station over public well being, environmental and human rights issues. Furthermore, multilateral growth banks have pledged to not fund new coal energy initiatives.

But coverage loopholes imply some proceed to not directly finance captive coal crops in Indonesia.

Captive coal additionally appears to be a caveat to China’s 2021 abroad coal plant moratorium, with Chinese language entities persevering with to take part in Indonesia’s captive coal business.

A number of on-grid initiatives additionally stay below development, with a few of this capability absolutely constructed however not but working as a result of grid overcapacity, equivalent to Unit 4 of the Banten Lontar energy station.

Indonesia faces a grid connectivity concern throughout its 1000’s of islands, with some provinces over-generating and others under-generating with out the mandatory electrical energy transmission infrastructure to hyperlink them.

The nation held a presidential election in February 2024, with Prabowo Subianto licensed because the president-elect in March. Prabowo has identified enterprise pursuits in coal and different fossil fuels and has been known as to divest from these firms earlier than taking workplace in October 2024.

In keeping with statements launched throughout his election marketing campaign, Prabowo’s five-year plan for the vitality sector included intentions to increase the usage of renewable vitality sources however didn’t point out coal plant retirements or an finish to new coal proposals.

However, the incoming administration shall be tasked with reconciling the captive emissions drawback and setting clear plans for the nation’s long-term vitality technique to ensure that the JETP settlement with worldwide companions to advance.

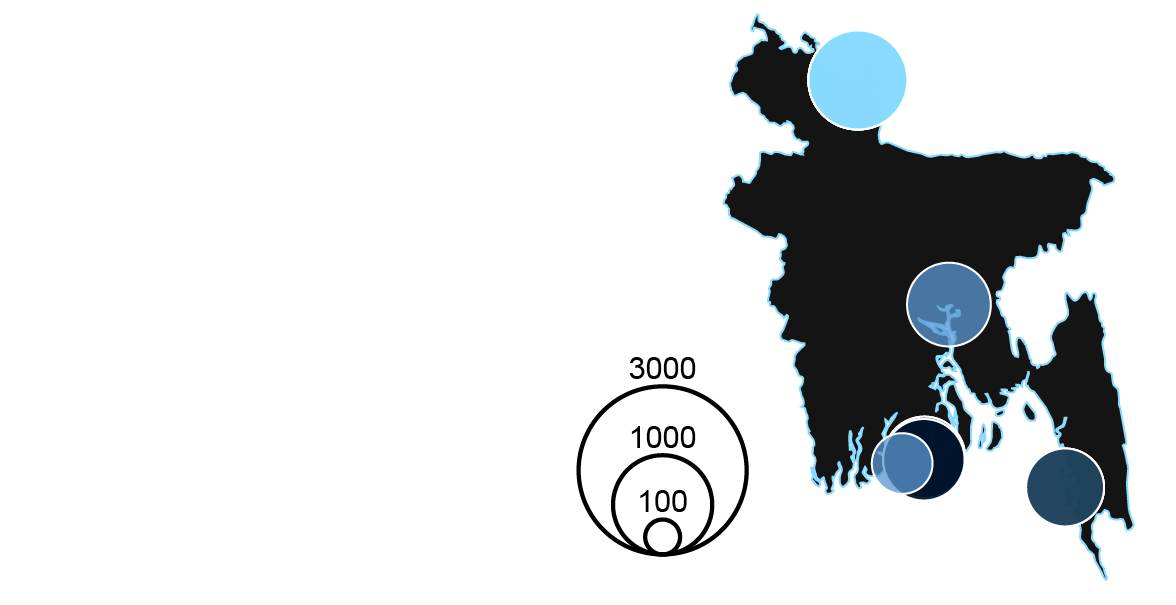

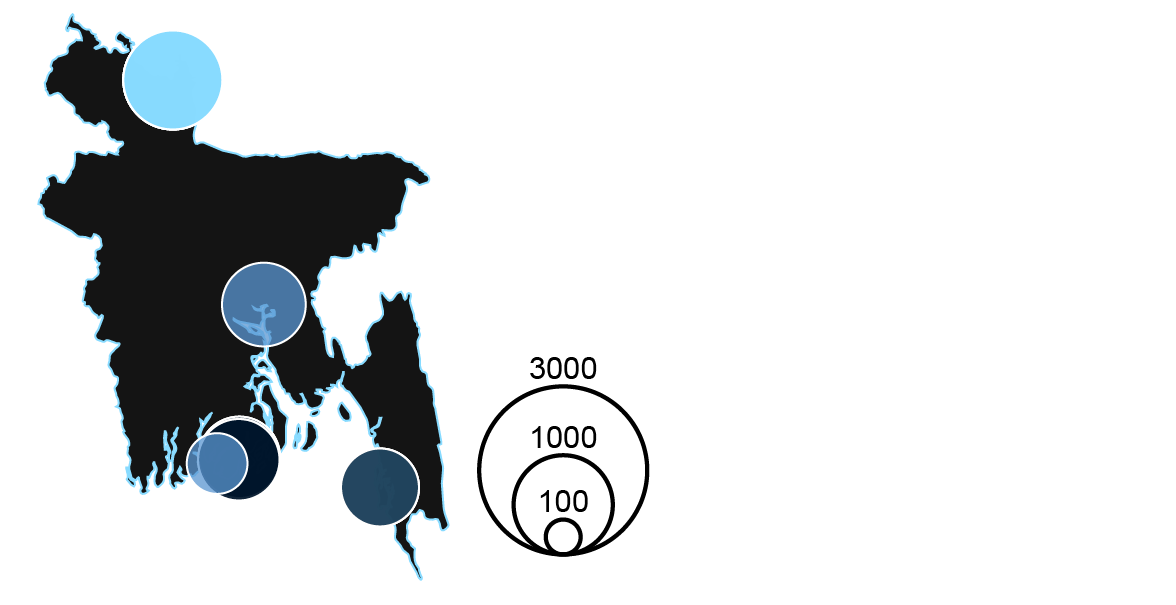

Bangladesh

Whole deliberate capability, GW

Bangladesh ranks fourth on the earth for coal energy below growth, with 6.3GW proposed and three.2GW below development as of June 2024, in line with the GCPT.

Whereas coal era extra than doubled from 2022 to 2023, Bangladesh has not introduced any new coal plant proposals since 2019. A suite of issues proceed to plague the gasoline, additional difficult by political unrest all through the nation in July and August 2024.

These issues embrace an ongoing greenback scarcity, the excessive price of imported coal and a buildup of unpaid electrical energy payments, which intensified a nationwide energy disaster within the first half of 2024, resulting in gasoline provide gaps and load shedding, regardless of adequate energy capability.

For instance, on the Matarbari energy station, Coal Energy Era Firm Bangladesh had but to obtain fee for energy provided to the nationwide grid from the plant’s working coal unit from December 2023 to Could 2024. The corporate is nonetheless searching for to finance an growth on the energy station, after shedding the venture’s authentic funding in 2022, when its sponsor, Japan, pledged to cease publicly funding new coal.

At S. Alam’s Banshkhali energy station, models that had accomplished development by late 2023 had been nonetheless not working at full capability in February 2024, as a result of grid constraints.

The nation noticed simply 0.7GW of coal energy come on-line within the first half of 2024 on the contested Rampal energy station, towards 1.3GW of deliberate coal capability cancelled in the identical interval.

In March 2024, a deliberate mine related to the Phulbari energy station – a fiercely contested venture that has been proposed in varied kinds for many years and has resulted within the loss of life of not less than three protestors – secured a $1bn funding settlement with PowerChina.

Although the facility station was not included on this preliminary financing settlement, China has not explicitly dominated out funding the plant, regardless of its 2021 pledge to cease constructing new coal crops overseas. The venture sponsors say that they anticipate the coal plant proposal to “turn out to be engaging” as a result of their proximity.

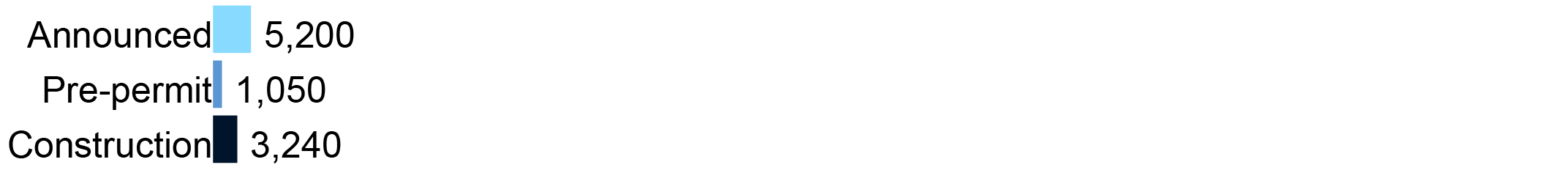

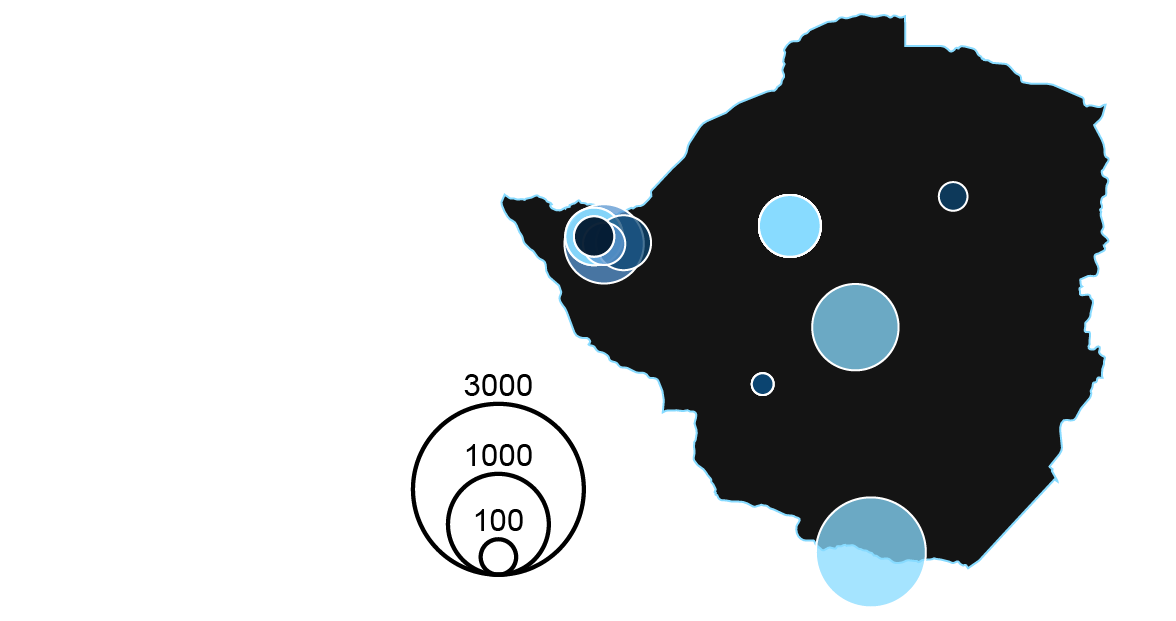

Zimbabwe

Whole deliberate capability, GW

Zimbabwe maintained its place as sub-Saharan Africa’s coal growth chief after the primary half of 2024, in line with the GCPT. The nation has 7.4GW of capability in pre-construction and development, and has continued to suggest new coal initiatives.

Zimbabwe has extra capability below growth than it did a decade in the past, and the nation has greater than tripled its share of the entire coal capability below growth globally, rating fifth as of June 2024.

On the heels of a accomplished 0.7GW growth by PowerChina on the Hwange energy station in Matabeleland North, Shandong Dingneng New Vitality Firm introduced plans to increase the coal plant by one other 0.6GW.

Earlier within the 12 months, Zimbabwean officers reportedly approached China about investments to assist with the nation’s ongoing electrical energy shortages. Frequent droughts have diminished the era capability of Zimbabwe’s Kariba Dam hydroelectric plant, whereas a rising industrial sector has boosted demand for energy.

The proposed Gweru and Status energy stations exemplify this rise in energy-intensive industries in Zimbabwe: each initiatives are captive coal crops slated to provide energy to Chinese language-backed chrome smelters. Zimbabwe’s authorities just lately instructed the smelters to safe their very own energy to ease demand on the nationwide grid.

Heavy industries and their captive coal initiatives have been met with blended reactions from surrounding communities. In keeping with native reporting, residents of Beitbridge in Matabeleland South are hopeful concerning the prospect of jobs from the Status venture. In the meantime, in Gweru and different components of the Midlands, neighborhood members say Chinese language smelter operations have precipitated the degradation of roads and rural lands, with the neighborhood left to foot the invoice.

China’s involvement within the captive initiatives and the brand new growth on the Hwange energy station are obtrusive examples of the anomaly of its 2021 pledge to cease constructing coal crops abroad.

Just like the obvious caveat for captive coal, growth initiatives related with present China-backed initiatives, equivalent to Hwange, appear to be thought of by China as an exception to the moratorium.

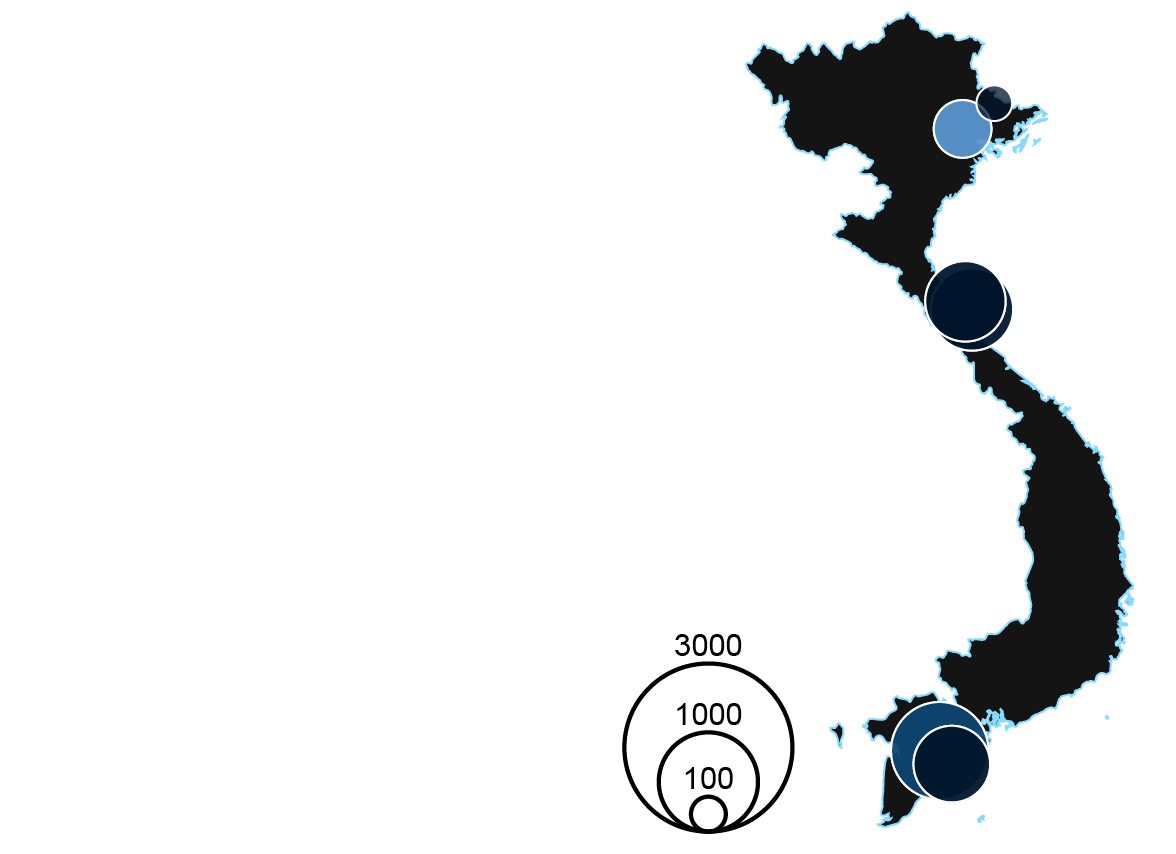

Vietnam

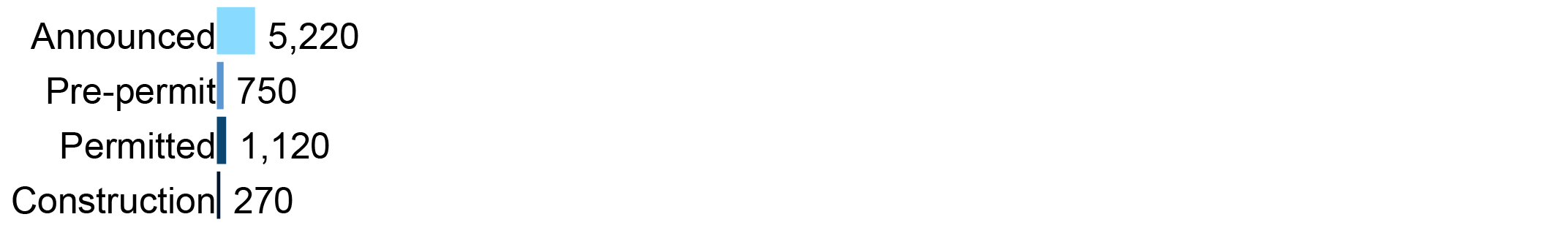

Whole deliberate capability, GW

In keeping with the GCPT, Vietnam has greater than tripled the dimensions of its working coal fleet within the final decade.

Whereas Vietnam has continued to operationalise and begin development on new coal-fired models within the first half of 2024, its whole capability below growth has dropped from 61.3GW in 2014 to six.7GW as we speak, bringing the nation nearer to commissioning what might be its final new coal plant.

In that interval, greater than twice as a lot capability has been shelved or cancelled as has been commissioned.

Up to date authorities vitality plans have eradicated progressively extra deliberate coal, and the newest model, the energy growth plan VIII (PDP8), requires coal to account for simply 20% of the nation’s electrical energy combine by 2030. That is down from the 53.2% projected for 2030 in PDP7 and the 34.2% current at PDP8’s launch in Could 2023.

PDP8 additionally initiatives that Vietnam’s coal capability will peak at 30.1GW, in comparison with the 27.2GW in operation as of June 2024.

Important proposed capability in Vietnam has been stalled for years, apparently unable to make developments due to a wide range of elements. PDP8 says that initiatives “not on time, dealing with difficulties in altering shareholders and arranging capital”, have till 30 June 2024 to both advance or be terminated.

Some initiatives, equivalent to Nam Dinh I, have subsequently pivoted to proposing the usage of liquified pure gasoline (LNG) via the primary half of 2024.

One other instance of a stalled venture is Tune Hau II, initially proposed about fifteen years in the past. It sought to attain monetary shut by the mid-2024 deadline, penning a mortgage settlement with lead arranger Export-Import Financial institution of Malaysia on 20 June.

Nevertheless, the monetary shut was not for the complete mortgage quantity wanted for the venture, and Vietnam’s Ministry of Business and Commerce finally terminated the venture’s “build-operate-transfer” contract in early July 2024.

The remaining initiatives below growth put Vietnam prone to breaching the circumstances of its JETP settlement, which mirrors the 30GW coal capability peak established in PDP8.

In keeping with the GCPT, the 4GW already below development alone would deliver Vietnam’s operational coal capability to 31.3GW, or 1.3GW above the JETP cap, presuming that no models are retired.

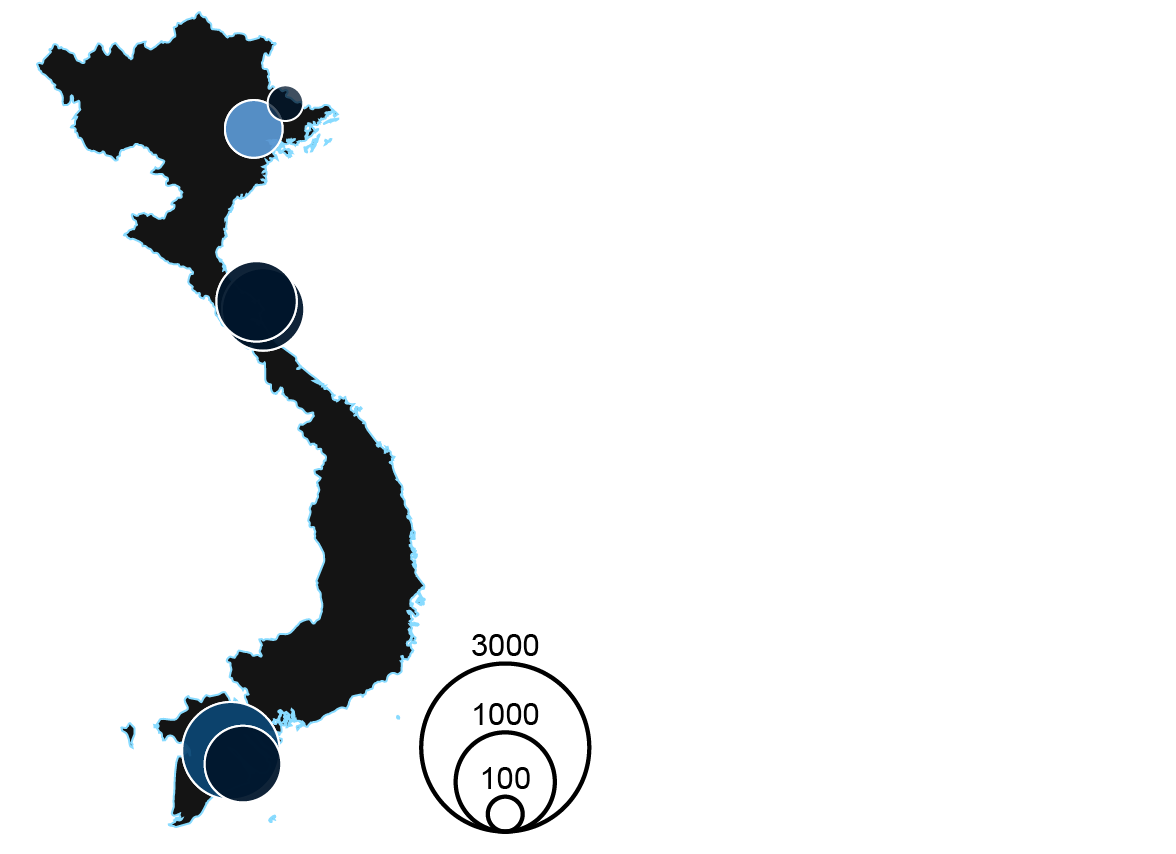

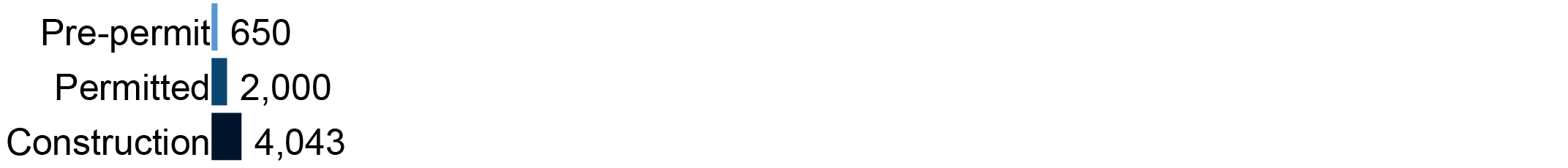

Laos

Whole deliberate capability, GW

Laos produces the vast majority of its electrical energy via hydropower, with over 4 instances extra working hydropower capability than coal-fired capa no metropolis in mid-2024.

The nation is a net-exporter of electrical energy, however periodic adjustments in era between the moist season from Could to October and the dry season from November to April end in intervals of vitality surplus and vitality scarcity.

Laos’ renewable vitality growth technique, regardless of largely specializing in the phaseout of fossil fuels, does name for two.5GW of “primarily” new hydropower and coal capability to be developed via 2025 to satisfy rising energy demand. The nation has 5.4GW of coal capability below growth as of June 2024.

The 0.7GW Nam Phan energy station started development in 2023, the primary in-construction coal plant in Laos since 2015, in line with the GCPT. Chinese language firm China Western Energy is designing and establishing the facility station, and the venture is deliberate to export electrical energy to neighbouring Vietnam.

The three part, 1.8GW Phonesack Xekong energy station additionally started preliminary work close to the related Phonesack coal mine within the first half of 2024, with the coal plant anticipated to be commissioned inside three years.

Just like the Nam Phan venture, the Houaphanh energy station was deliberate with a Chinese language firm and would export electrical energy to Vietnam, however the proposal has not progressed in a number of years. Two different proposals in Laos are additionally stalled, seemingly as a result of a scarcity of funding.

Even when the remaining coal-fired energy stations had been cancelled, Laos has ongoing plans for home coal manufacturing and elevated coal exports via to not less than the top of the last decade.

Russia

Whole deliberate capability, GW

Russia has 37.8GW of working coal energy capability, with coal accounting for 16.6% of whole era in 2023.

Within the final decade, the nation has retired or transitioned to gasoline some 7.7GW of coal capability, whereas commissioning 2.8GW of recent coal capability, in line with the GCPT.

Most coal crops are situated in Siberia and the Far East, the place Russia’s hydropower crops are additionally concentrated. The coal crops usually reply to the seasonality of hydropower by adjusting their manufacturing.

The modernisation of ageing tools and transition to gasoline have been overriding themes for Russian thermal coal crops within the final decade.

For instance, Khabarovsk-3 is within the means of changing 0.5GW of coal capability to gasoline, and the gas-fired Artyomovskaya energy station-2 will exchange coal models on the Artyomovskaya energy station.

Russia can also be trying to increase the gasoline transportation system for exports to China, in an effort to switch gasoline exports to the European Union.

As of June 2024, 4.5GW of coal capability is in planning in Russia and simply 0.6GW is below development. Three proposals, with virtually 2GW of mixed capability, seem like inactive, though they’re nonetheless listed in latest authorities planning paperwork.

In March 2024, two new coal models had been introduced on the present Irkutsk-11, to cowl the recognized energy deficit within the Irkutsk area. The proposal seems to be superseding plans for the now-shelved EN+ Mugunsky energy station.

On the Partizanskaya energy station within the Far East, two models entered development in 2024 and are slated to provide electrical energy to Russian Railways, as a part of a state venture to extend the capability of the Trans-Siberian Railway.

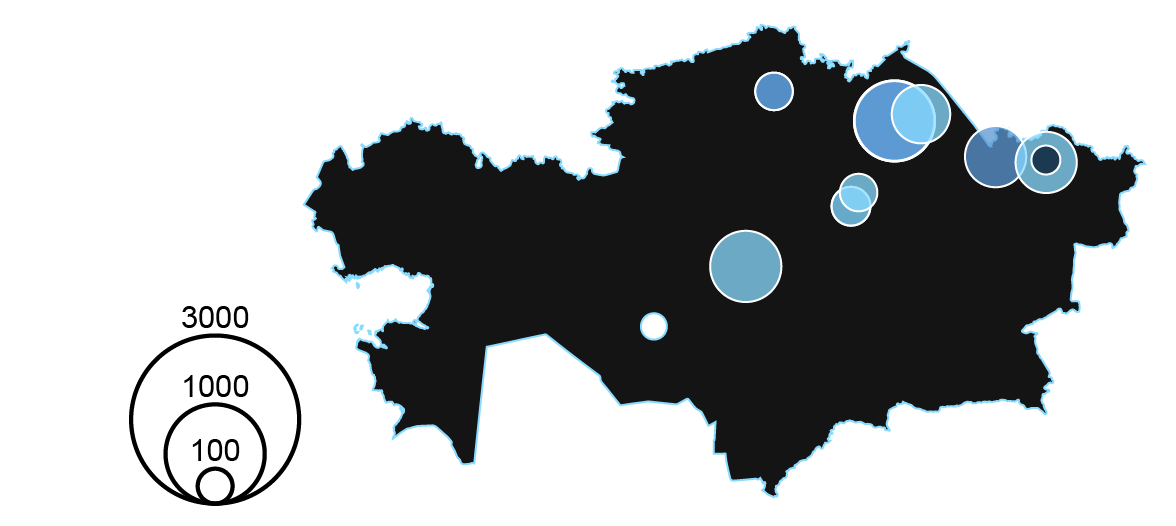

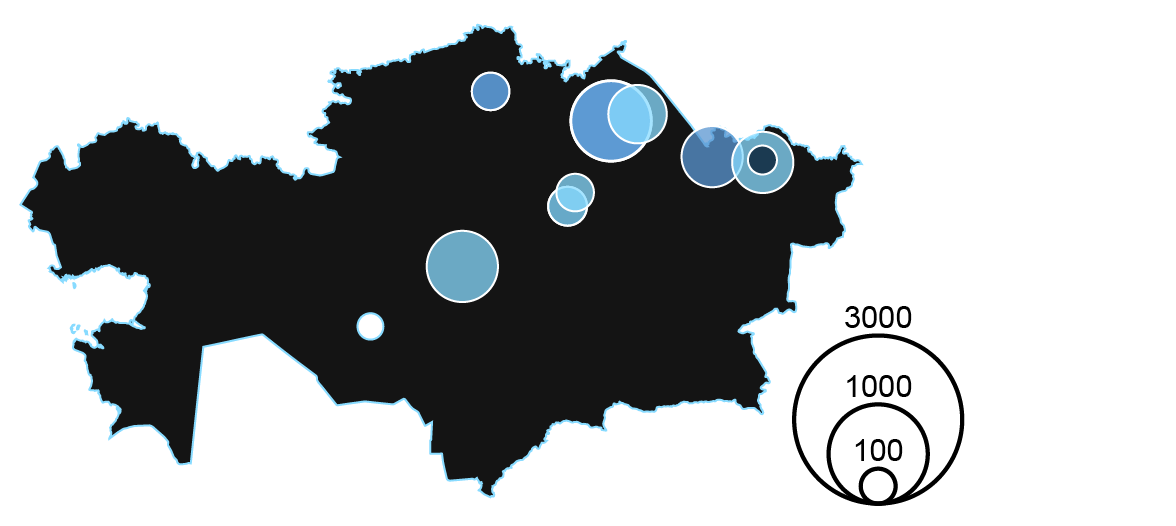

Kazakhstan

Whole deliberate capability, GW

Kazakhstan has considerable coal reserves and developed coal infrastructure, with coal fuelling two-thirds of the nation’s energy era.

The nation is dealing with rising home demand for energy and has outdated vitality infrastructure, complicating a transition to cleaner fuels.

Worn-out infrastructure in each thermal energy stations and the grid have resulted in quite a few failures and provide interruptions lately. Since many services are mixed warmth and energy crops (CHPs), the failures go away residents with out warmth through the nation’s harsh winters.

In early 2024, in response to anticipated energy capability wants and excessive charges of energy tools depreciation, Kazakhstan’s Ministry of Vitality developed an motion plan and printed an order on energy sector growth via 2035 that foresees constructing 26.5GW of recent energy capability, together with over 4GW of recent coal capability.

The biggest proposed coal initiatives are in Ekibastuz, a serious coal mining centre in northeastern Kazakhstan, with 1.3GW of coal capability deliberate at Ekibastuz-2 and a 1.3GW greenfield growth proposed at Ekibastuz-3.

One of many growth models at Ekibastuz-2 has been deliberate for a few years, with tools from China reportedly delivered on website.

Nevertheless, latest stories have indicated {that a} Russian firm shall be contracted to construct the growth, with the Chinese language tools used at Ekibastuz-3 as a substitute.

Though development was stated to be imminent at Ekibastuz-2 in early 2024, it had not but begun as of June 2024, the GCPT exhibits.

In late 2023, Kazakhstan additionally signed agreements with Russian public vitality firm Inter RAO to construct three coal-fired CHPs in north-east Kazakhstan, totalling almost 1GW of capability.

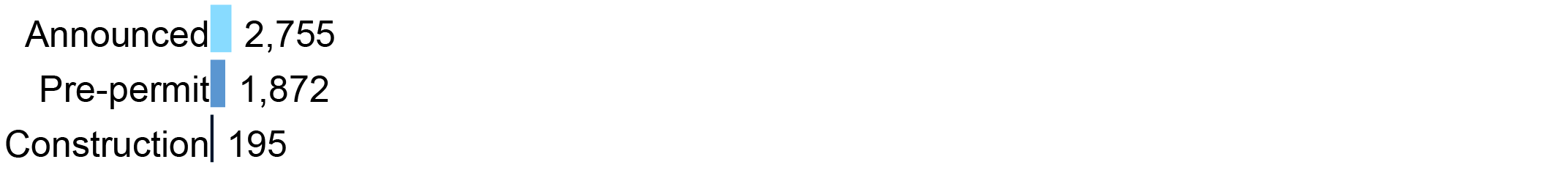

Turkey

Whole deliberate capability, GW

The 4.8GW of coal capability remaining below growth in Turkey is essentially stalled, the GCPT exhibits.

Most proposed and working coal crops within the nation have confronted fierce native resistance lately, predominantly surrounding worsening environmental and public well being impacts.

Neighborhood opposition can also be usually coupled with authorized motion, with initiatives such because the Kirazlıdere energy station having a number of open instances filed towards the plant concurrently.

Court docket selections have blocked a number of coal plant proposals, together with the Alpu and Ilgın energy stations, contributing to the 73.8GW of coal capability that has been cancelled in Turkey since 2014.

Solely one of many 4 pre-construction proposals in Turkey made progress within the first half of 2024, in line with the GCPT.

Afsin-Elbistan A, a part of the sizable Afşin-Elbistan energy station advanced within the metropolis of Kahramanmaraş, has a 0.7GW growth proposal below environmental affect evaluation (EIA) assessment as of June 2024. Residents of the encompassing space impacted by air pollution from the present plant had been calling for the Ministry of Setting, Urbanisation and Local weather Change to reject the EIA.

Turkish president Recep Tayyip Erdoğan had proven assist for deforestation within the Akbelen forest in favour of coal mine expansions, however the opening of the land for mining use was reversed in March 2024. Nonetheless, following infrastructure injury from the February 2023 earthquake and Erdoğan’s February 2024 name for elevated vitality independence, Turkey continues to pursue coal growth.

The nation is continuous to rely on lignite coal relatively than changing the gasoline with less expensive and clear options.

The nation’s 2022 nationwide vitality plan initiatives a 3.2GW rise in coal energy capability from 2025 to 2035.

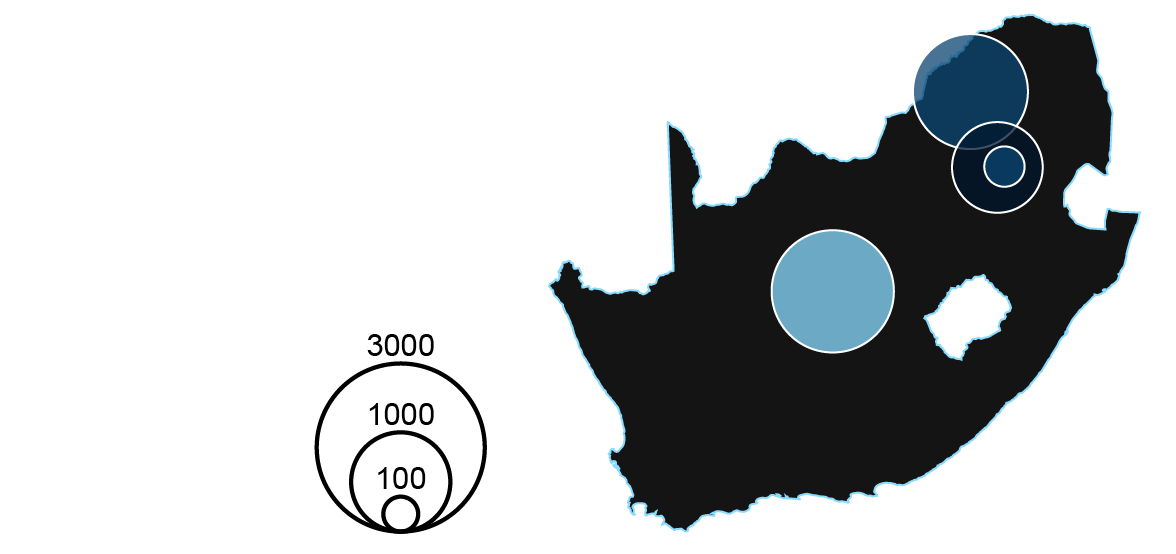

South Africa

Whole deliberate capability, GW

South Africa runs the world’s sixth largest working coal fleet, however the nation faces an enduring vitality disaster that started with rolling blackouts in 2007.

In early 2024, the South African authorities launched an up to date draft built-in useful resource plan that was “insufficient plan to sort out the nation’s energy provide disaster and its lack of consideration to air high quality and local weather change places it in battle with the regulation and worldwide agreements”, Bloomberg reported, citing the nation’s presidential local weather fee.

The plan was broadly criticised by vitality, enterprise and neighborhood teams for its reliance on ageing coal energy crops and for a scarcity of ambition on renewable vitality.

State-owned utility Eskom has proposed delaying retirements at three coal-fired energy crops, a transfer that might jeopardise South Africa’s $9bn JETP financing.

As of July 2024, nonetheless, the federal government was searching for to renegotiate its JETP deal to increase the lifetime of its present coal crops. Following South Africa’s mid-2024 election, the nation’s newly-appointed minister of forestry, fisheries and the surroundings acknowledged that South Africa’s simply vitality transition is “the large concern”, and the newly-appointed minister of electrical energy and vitality promised to be “ultra-aggressive” in renewable vitality growth.

Nonetheless, South Africa ranks second behind Zimbabwe for essentially the most coal capability below growth (3.8GW) in Sub-Saharan Africa.

One of many proposed coal initiatives, the Chinese language-backed Musina-Makhado energy station, has an more and more unsure future: builders for the Musina-Makhado “particular financial zone” had been additionally constructing a photo voltaic plant as of February and in April proposed small modular reactors to provide the world with nuclear energy.

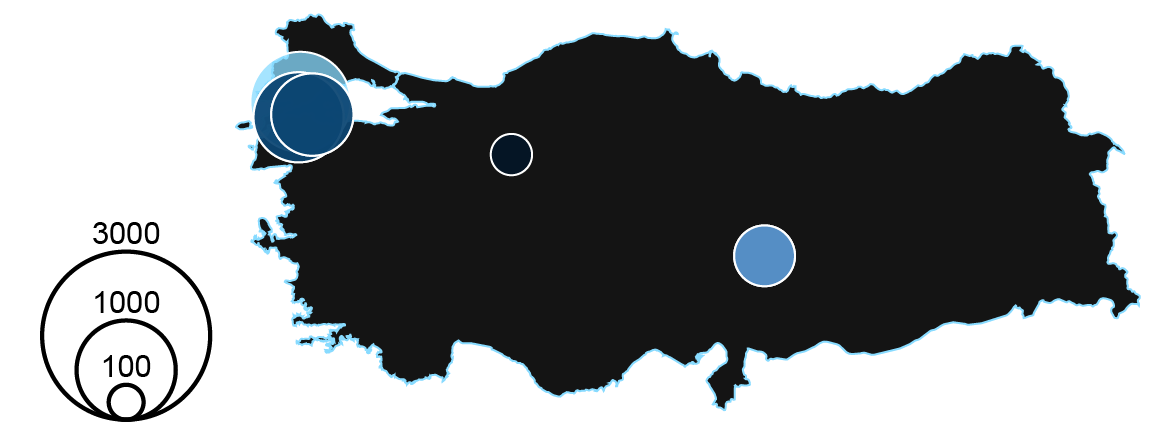

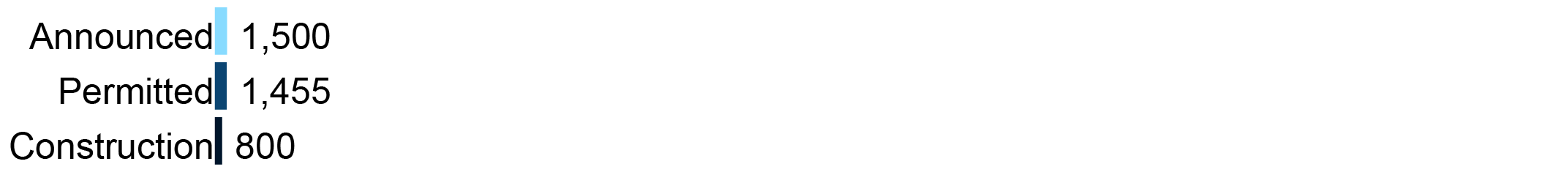

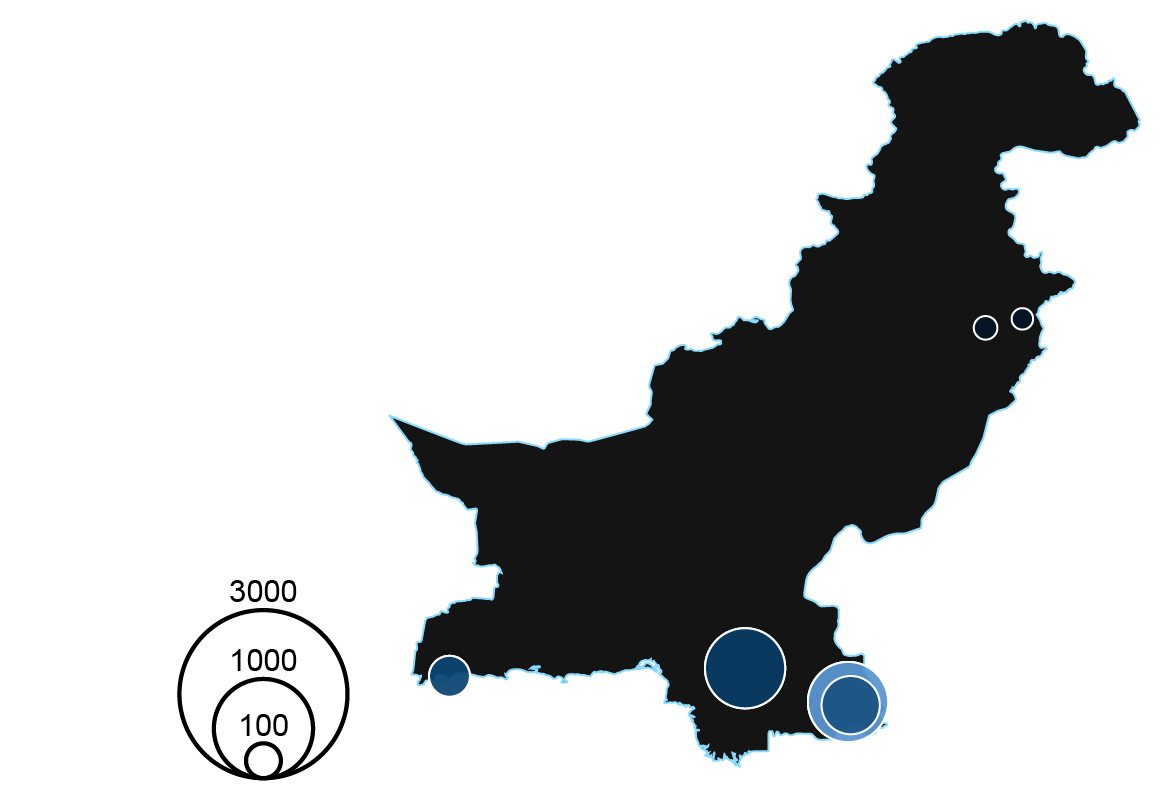

Pakistan

Whole deliberate capability, GW

Pakistan noticed little change to its proposed and working coal capability within the first half of 2024, in line with the GCPT, but the coal business and vitality sector had been brimming with exercise.

The nation continues to be grappling with a number of confounding issues, together with a weak Pakistani rupee, nationwide debt, tariff disputes, expensive coal imports and the geopolitical undercurrent of the struggling China-Pakistan financial hall (CPEC).

In Could 2024, Pakistan’s minister of planning promised that the Gwadar energy station – a key CPEC venture – would have a groundbreaking ceremony by the top of the 12 months. Nevertheless, in the identical month, the venture’s Chinese language insurer acknowledged that Pakistan owes Chinese language firms a mixed $1.7bn and that it could not allow further capital injections into Pakistan’s energy sector.

On the Jamshoro energy station, the commissioning of a newly-built coal unit stalled as a result of delays in procuring coal.

In July 2024, a Pakistani delegation visiting Beijing obtained approval to swap three Chinese language-backed energy stations from imported coal to home Thar coal, a lower-quality lignite that may have an effect on plant efficiencies and should find yourself undermining Pakistan’s want for vitality independence. Whereas the lignite is mined and used regionally, Thar initiatives are carefully tied to overseas firms and international monetary markets whose affect may weaken the financial advantages and home management that Pakistan seeks.

The proposal follows an settlement with the Worldwide Financial Fund for a $7bn mortgage program to keep away from Pakistan defaulting on present money owed.

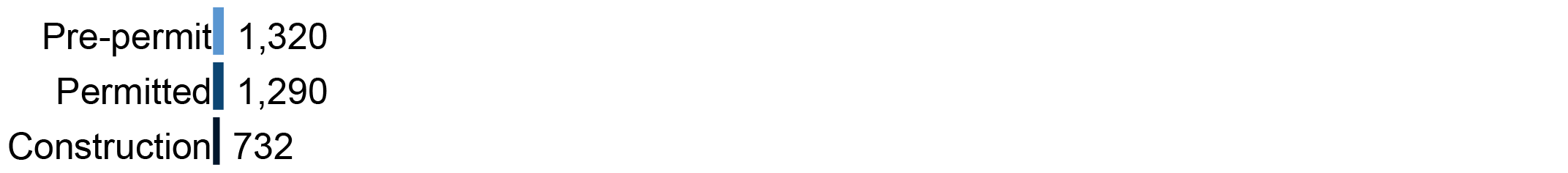

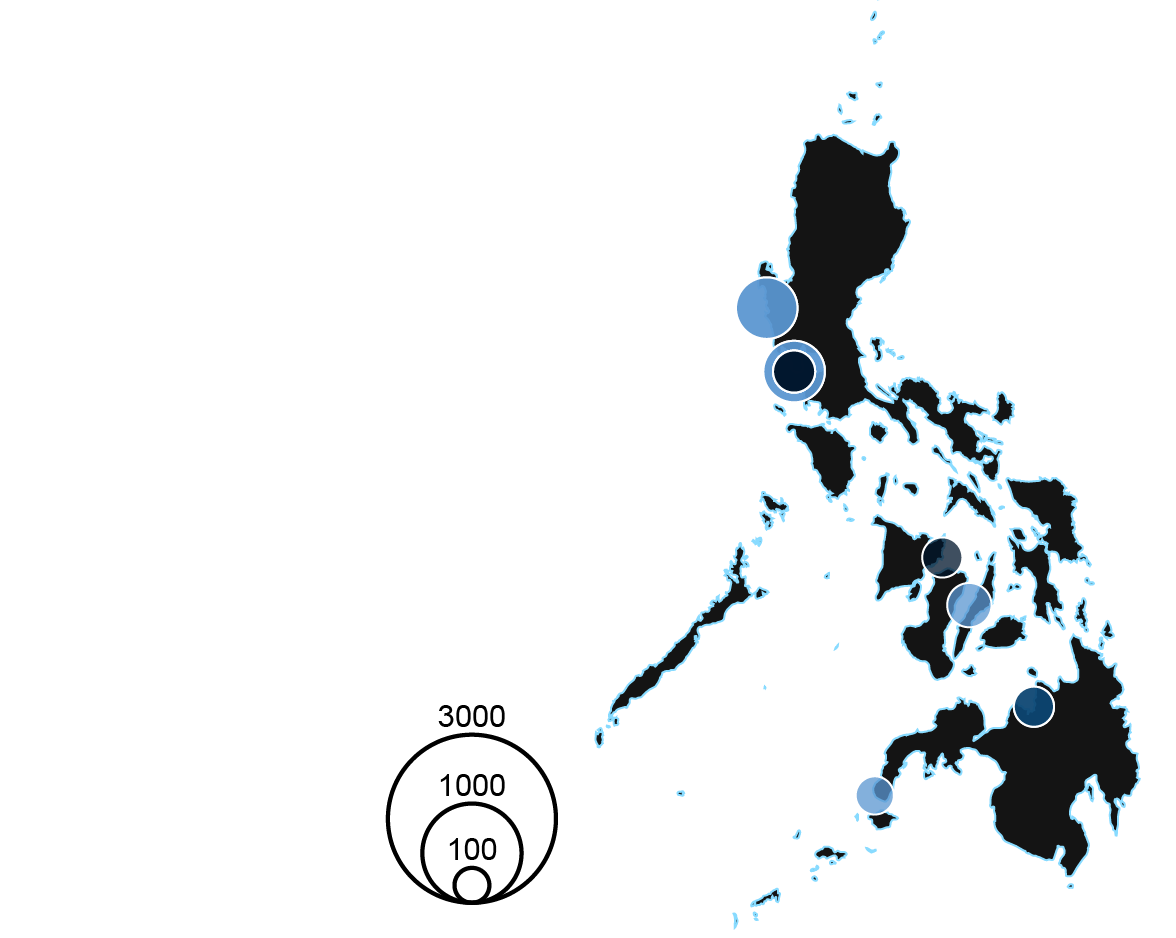

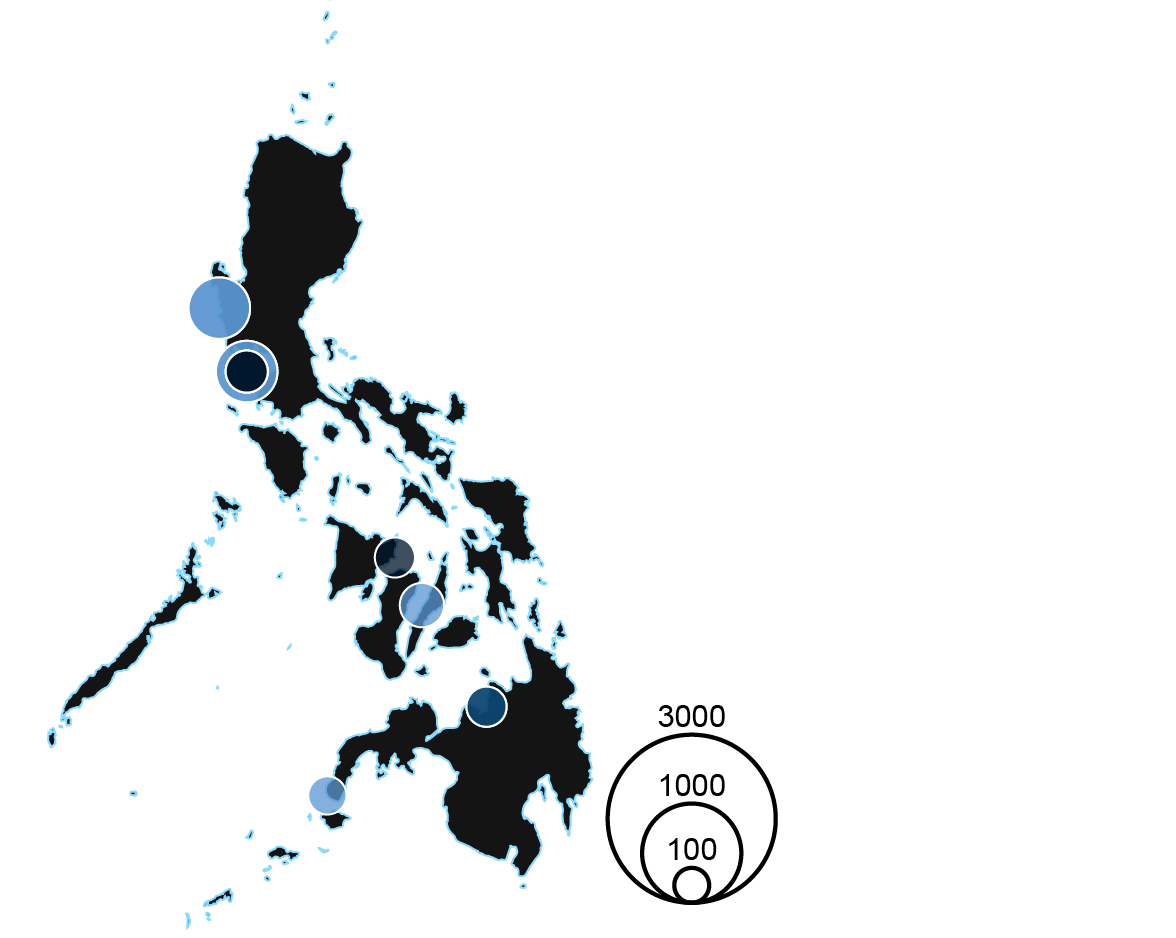

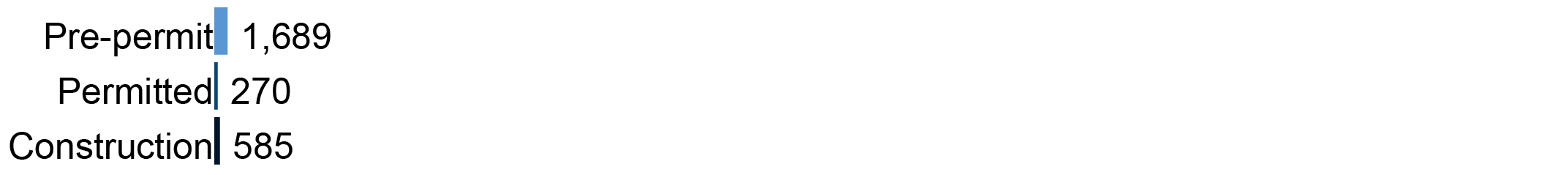

Philippines

Whole deliberate capability, GW

The Philippines’ moratorium on new coal plant permits, introduced in October 2020 following a sustained public opposition marketing campaign to new coal, has typically slowed the event of the nation’s proposed coal crops.

Nevertheless, 2.5GW of coal capability stays below growth because the GCPT exhibits, and the Philippine authorities has continued to approve exemptions for coal venture proposals within the first half of 2024.

In January 2024, the Philippines’ Division of Vitality (DOE) declared that an growth unit on the Therma Visayas Vitality Undertaking could be exempt from the nation’s coal plant moratorium, claiming that the unit had already secured its environmental compliance certificates previous to the moratorium’s implementation. In response, local weather activists and advocacy teams have known as on the DOE to rescind its endorsement of the growth.

One unit started working on the two-phase SMC Mariveles energy station in March 2024, however coal plant proposals below growth within the Philippines have in any other case largely stalled or seen sluggish progress.

The initiatives have been deterred by a common dearth of financing and right-of-way points with transmission strains and infrastructural growth – together with growth models on the Masinloc and Calaca energy stations, with plans for the latter put on maintain by the plant’s proprietor in Could 2024.

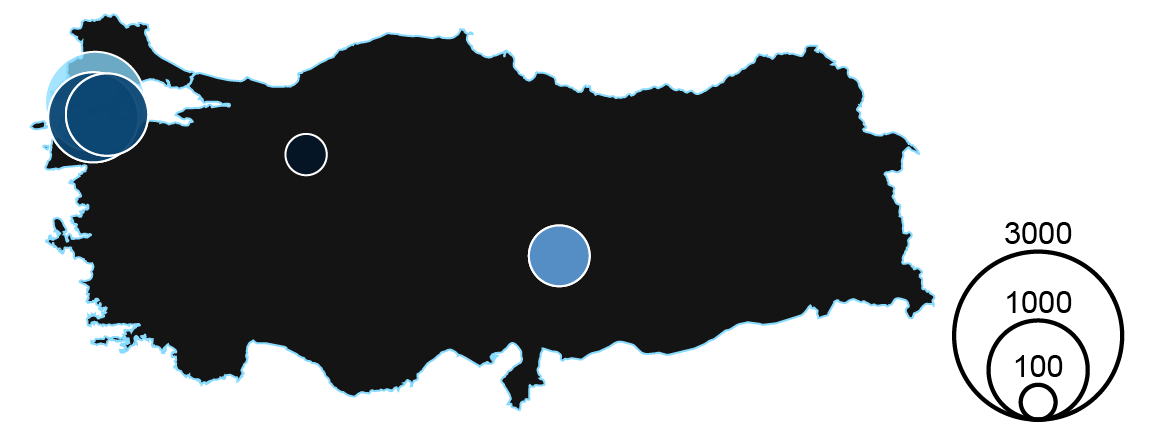

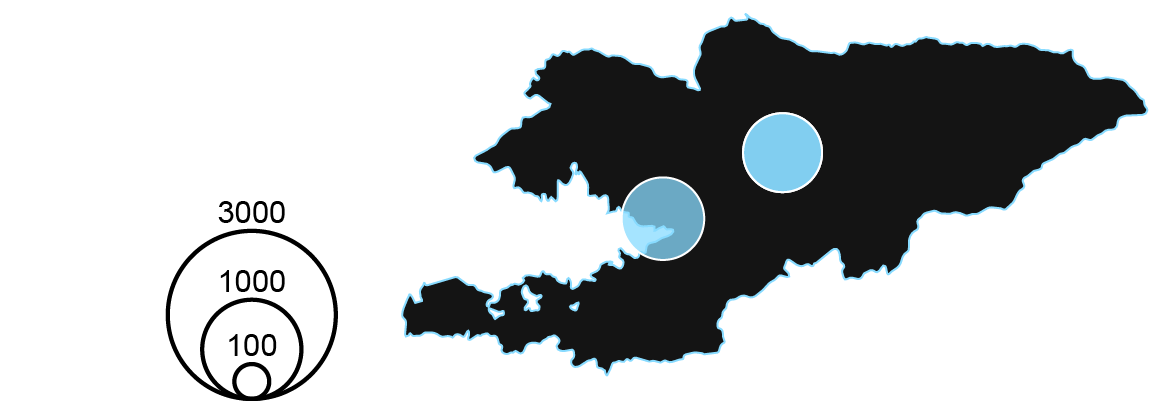

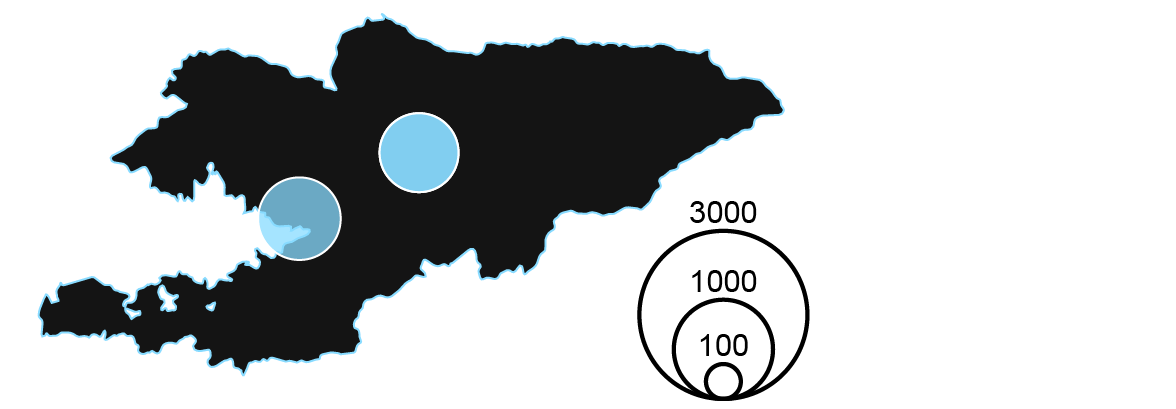

Kyrgyzstan

Whole deliberate capability, GW

Kyrgyzstan tripled its coal capability below growth from 2022 to 2023 and was one in every of simply eight nations to extend its proposed coal capability throughout the 2023 calendar 12 months, the GCPT exhibits.

As just lately as 2021, Kyrgyzstan had no lively coal plant proposals below growth. In early 2022, nonetheless, plans for the 0.6-1.2GW Kara-Keche energy station – which had been in planning from 2014 to 2016 – was revived.

In January 2024, the Ministry of Vitality and China Nationwide Electrical Engineering signed a memorandum for the development of a 0.6GW coal unit in Kara-Keche, in addition to a number of hydropower crops.

In late 2023, the 0.7GW coal-fired Jalal-Abad energy station was introduced to be constructed by a Russian contractor. Coal manufacturing was additionally to be expanded within the nation, with plans to use the Kara-Tyt coal deposit established on the 2023 Kyrgyz-Russian interregional convention.

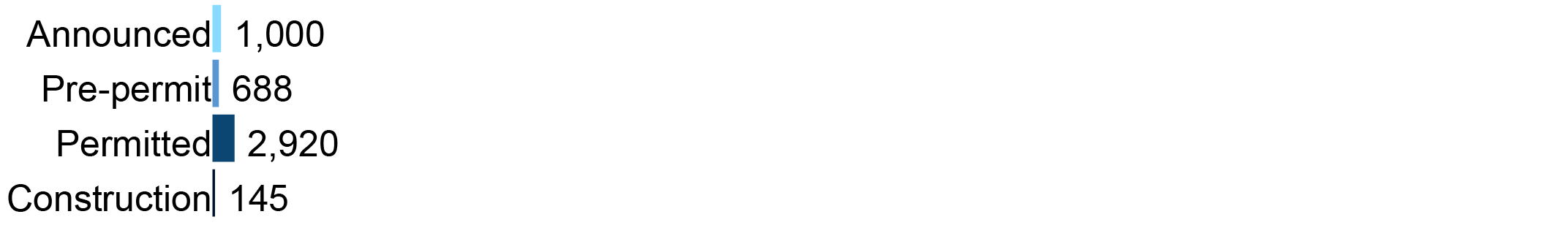

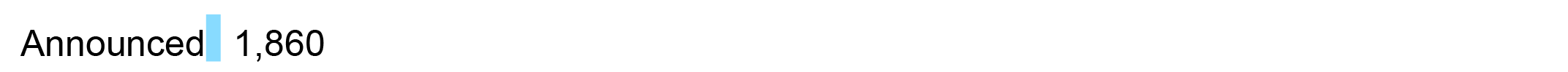

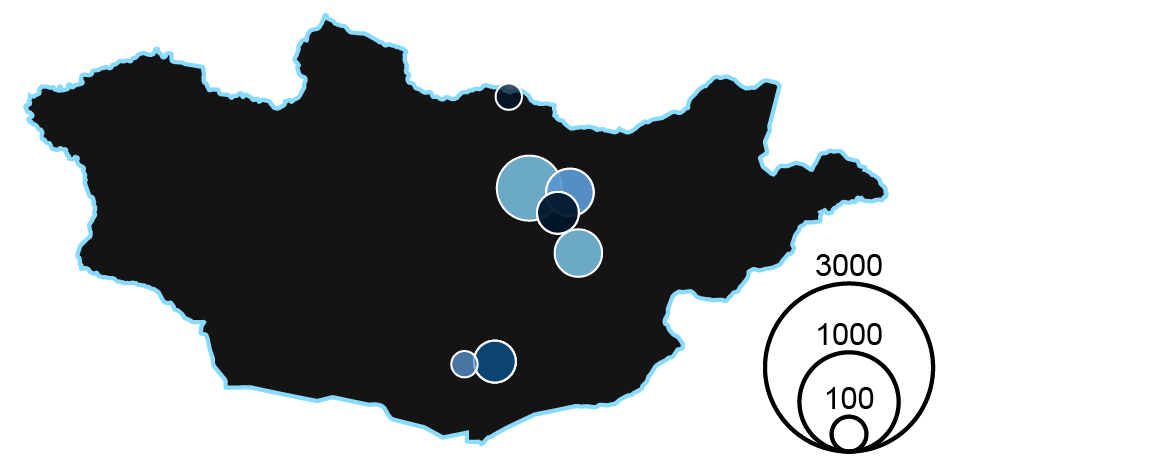

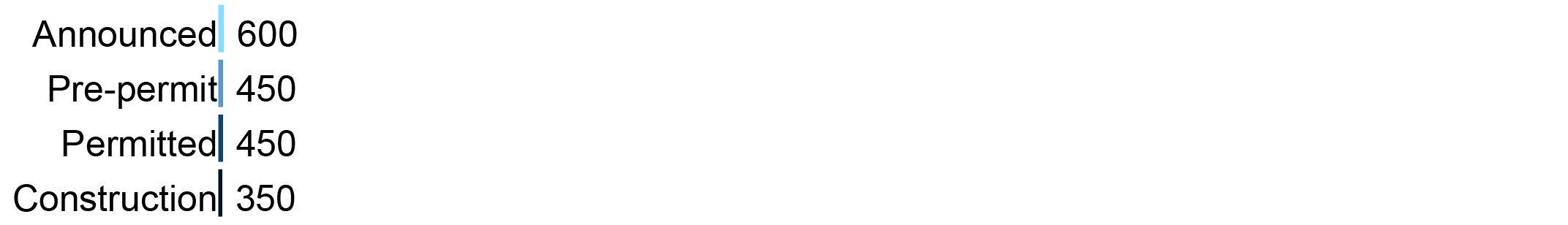

Mongolia

Whole deliberate capability, GW

Mongolia’s coal capability below growth sits at 1.9GW, in line with the GCPT.

This capability slowly declined from a excessive of 8.1GW in 2014 after which sharply fell in 2023, with the shelving of 5.3GW on the Shivee Ovoo energy station, a long-proposed mega venture that has by no means discovered adequate assist.

As of March 2024, the long-awaited Tavan Tolgoi energy station which is ready to provide energy for home mining operations, remained in limbo and not using a contractor – after a failed tender course of in 2023.

Different initiatives superior within the nation, with the small CHP Sükhbaatar energy station starting development and the growth of Dornod energy station beginning operation.

The designations employed and the presentation of the fabric on this map don’t indicate the expression of any opinion by any means on the a part of Carbon Temporary regarding the authorized standing of any nation, territory, metropolis or space or of its authorities, or regarding the delimitation of its frontiers or boundaries.

Sharelines from this story