The majority of steelmaking all over the world nonetheless depends on coal-based blast furnaces.

Consequently, the metal and iron business is liable for 7% of greenhouse gasoline emissions and 11% of carbon dioxide emissions globally, in response to the consultancy agency International Effectivity Intelligence.

That is greater than the entire emissions from all of the world’s automobiles and vans.

With metal crucial to the constructing out of decarbonised vitality infrastructure, manufacturing is anticipated to proceed to rise over the approaching years, which means the potential for decarbonisation is “monumental”, in response to not-for-profit information organisation International Vitality Monitor (GEM).

GEM’s annual “Pedal to the Metallic” report reveals that 93% of recent steelmaking capability introduced to this point in 2024 guarantees to make use of decrease emission electrical arc furnaces (EAFs).

It additionally reveals that 49% of the world’s steelmaking capability below improvement now makes use of EAFs, up from simply 43% in 2023 and 33% in 2022.

Of this, practically the entire capability introduced for the reason that starting of 2024 operates utilizing EAFs, the non-governmental organisation’s International Metal Plant Tracker (GSPT) reveals.

The tracker covers 2,207m tonnes per 12 months (mtpa) of working steelmaking capability and a further 774mtpa of steelmaking capability below improvement globally, throughout 1,163 particular person vegetation in 89 completely different international locations, evaluation of which is captured in its annual report.

Nonetheless, whereas the report suggests a constructive development in the direction of decrease emission applied sciences within the sector, the rise within the introduced initiatives just isn’t but resulting in a building of EAF overtaking coal-based manufacturing strategies.

Coal-based blast furnace-basic oxygen furnaces (BF-BOFs) – the place blast furnaces are used to supply iron from ore and oxygen converters then flip this, with some extra parts, into metal – proceed to dominate the initiatives below building, which means “strain have to be maintained throughout to venture completion if actual progress is to be seen”, the report finds.

Progress of EAFs

Incoming steelmaking capability is extra closely EAF-based than ever earlier than, in response to GEM’s new report.

There may be at present 774mtpa of steelmaking capability below improvement, of which 223mtpa is within the superior improvement stage.

Primarily based on information from April 2024, the GSPT reveals that just about half of the capability below improvement (337mtpa) is EAFs.

Simply 36% of steelmaking capability introduced in 2020 with a identified manufacturing route used EAFs, whereas in 2023 that quantity had elevated to 92% in response to GEM. This grows to 93% of capability when taking a look at steelmaking capability below improvement introduced in 2024.

This “signifies a major shift towards electrical arc furnace steelmaking within the years to come back”, the report notes.

In the meantime, of the 212mtpa of steelmaking capability slated for retirement, 88% if BOF-based.

Nonetheless, a internet improve in BOF-based capability is anticipated over the approaching years. If all deliberate developments and retirements take impact, a further 171mptpa of BOFs is anticipated to be added to the worldwide fleet, together with 310mtpa of EAF and 80mtpa of unknown applied sciences.

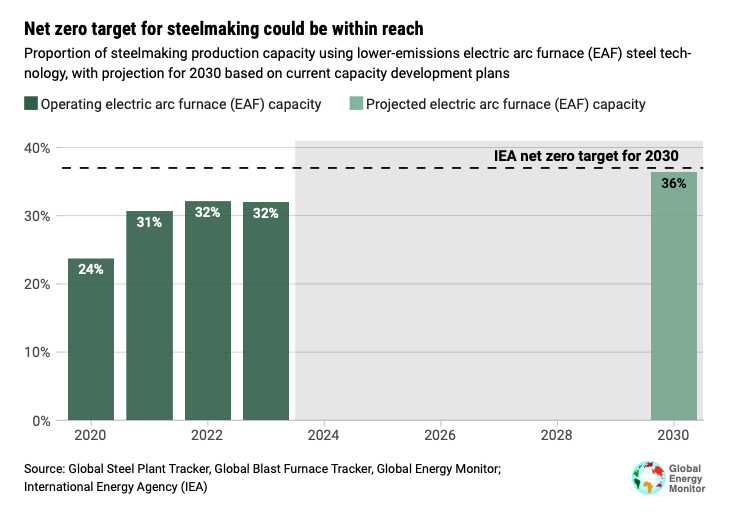

Regardless of this progress in BOFs, the surge of EAF means the metal sector is getting more and more near assembly the Worldwide Vitality Company’s (IEA) prompt 2030 goal.

In its net-zero by 2050 roadmap, the IEA means that the share of metal produced by EAF ought to develop from 24% in 2020, to 37% by 2030 after which 52% by 2050.

Contemplating all deliberate capability and retirements, GEM now estimates that the worldwide metal fleet is anticipated to achieve 36% EAF by 2030, noting: “That is nonetheless not adequate to fulfill the IEA [net-zero] local weather goal, however with heightened momentum the aim is more and more attainable.”

Persevering with to building

Whereas EAF-steelmaking is being introduced at “file fee”, GEM finds that lower than 14% of this potential capability has moved into building.

Of those who have moved into building, round 46% are nonetheless BOF-based. As such, “whereas we could also be inside attain of net-zero targets primarily based on proposed electrical arc furnace capability, really attaining these objectives requires follow-through”, the report notes.

Caitlin Swalec, program director for heavy business at GEM, stated in an announcement:

“The progress is promising for a inexperienced metal transition. By no means earlier than has this a lot lower-emissions steelmaking been within the pipeline. On the identical time, the buildout of coal-based capability is regarding. What the business wants now’s to make these clear improvement plans a actuality, whereas backing away from coal-based developments.”

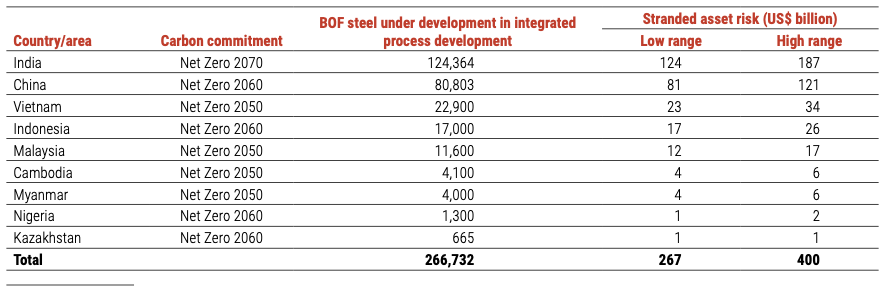

In addition to the buildout of recent coal-based capability being out of alignment with a net-zero future, it poses a menace of carbon lock-in and stranded property, GEM notes.

Blast furnaces have gotten riskier investments given the restricted choices to mitigate emissions from each the furnaces themselves and the upstream emissions from the metallurgical coal mining, it provides.

Estimating an funding of $1-1.5bn per mtpa capability at an built-in BF-BOF website, GEM discovered that the long run stranded-asset threat may very well be as excessive as $554bn in 2023, falling to $400bn in 2024 because of the continued fall in BOF capability below improvement.

Astrid Grigsby-Schulte, venture supervisor for metal at GEM tells Carbon Transient:

“As we develop nearer to key decarbonisation milestones, coal-based developments get additional out of alignment with the route the business is transferring and current a better threat of stranded property to steelmakers. Coal-based, emissions-intensive blast furnaces symbolize vital investments that always require a long time to recoup. This makes them extraordinarily dangerous for builders, notably in international locations with acknowledged internet zero commitments.”

The restricted choices for mitigating the local weather impression of BOF-steelmaking was additionally highlighted inside a latest report from the thinktank Sandbag.

Whereas carbon seize, utilisation and storage (CCUS) is usually touted as a “catch all” answer, its effectiveness varies broadly throughout functions, Sandbag’s “Metal & CCS/U” report finds.

For metal manufacturing, BF-BOFs with carbon seize are unlikely to be cost-competitive with EAFs, the report finds. Though given the sluggish tempo of technological and market improvement, Sandbag anticipates capturing carbon will play a restricted function within the metal business.

China transitions to EAFs

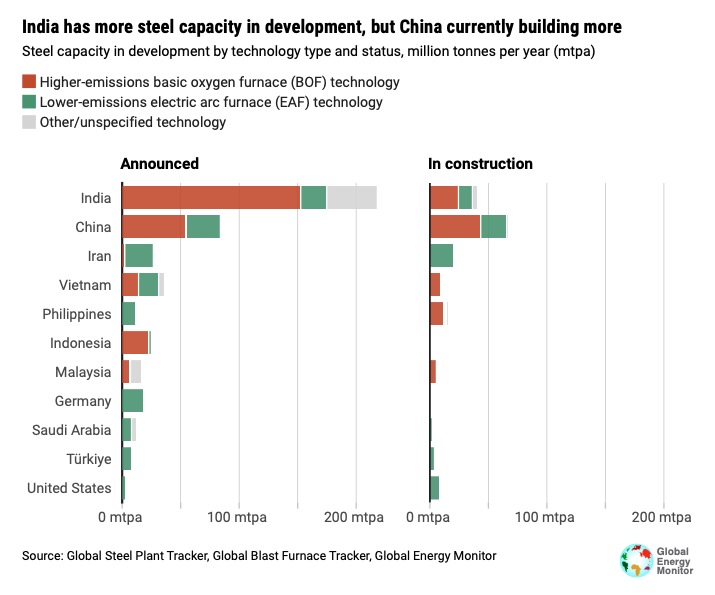

India has now changed China as the highest metal developer globally, with a pipeline of 258mtpa of capability, of which 177mtpa is BOFs, in response to GEM.

China has a pipeline of 150mtpa which means, collectively, China and India are liable for 53% of all developments globally.

Asia operates 68% of all steelmaking capability (1,508mtpa), nearly all of which is in China (1,075mtpa), India (123mtpa) and Japan (109mtpa).

When trying particularly at emissions-intensive BOF manufacturing, Asia’s share of whole working capability will increase to 80% (1,181mtpa), of which 918mtpa is in China.

Presently, China has 157mtpa of working EAFs (22% of the worldwide capability), adopted by the US, Turkey, Iran after which India.

In accordance with a brand new report from the Centre for Analysis on Vitality and Clear Air (CREA), China didn’t subject any new permits for coal-based steelmaking within the first half of 2024. That is the primary time this has occurred for the reason that nation’s “twin carbon objectives” had been introduced in September 2020.

Throughout the first six months of 2024, Chinese language provincial governments permitted 7.1mtpa of steelmaking capability, all of which had been EAFs marking a “turning level” for the nation’s metal business, CREA notes.

Xinyi Shen, researcher at CREA and the report’s lead writer, tells Carbon Transient: :

“China’s EAF steelmaking has been creating fairly slowly previously few a long time, primarily because of the constraint of scrap provide. Nonetheless, as China’s metal demand reaches its peak and extra scrap turns into obtainable, a serious alternative arises to scale back emissions within the subsequent 10 years. The federal government has accelerated plans to increase the nationwide ETS to incorporate the metal sector by the second half of 2024. By implementing carbon pricing on carbon-intensive merchandise, EAF steelmaking would develop into extra economically aggressive and proceed the expansion.”

Regardless of India now overtaking China by way of introduced steelmaking capability, China stays the largest developer of EAF capability general, GEM’s report states. And whereas India has probably the most metal in improvement, 84% has not moved into building.

As such, there’s nonetheless a chance for India’s plans to vary, with the proportion of BOFs to EAFs much less set.

Chris Bataille, adjunct analysis fellow on the Columbia College Heart on International Vitality Coverage and lead writer on the world Web Zero Metal venture tells Carbon Transient:

“India’s core demand for metal is ready to extend from 125mtpa to ~450mtpa by 2050, particularly to fulfill key constructing and infrastructure wants. Our modelling suggests EAFs persistently rise from ~35 to 150mtpa by 2050. So the +250mtpa BF-BOFs is simply barely possible, however solely over ~25 years and with some exports of BF-BOF metal.

“The distinction will likely be between a world the place sturdy local weather coverage succeeds and fails. If it fails and coal primarily based BF-BOFs are constructed, then the +258mtpa appears barely possible. If it succeeds, India is brief on the mandatory gasoline and particularly clear electrical energy to energy this quantity of metal manufacturing. Whereas the nation does construct numerous EAFs, it builds as much as 250mtpa of fresh iron making over time, making the quick time period shortfall with clear HBI iron imports.”

Sharelines from this story