China and South Korea are planning to construct greater than 112 gigawatts (GW) of gas-fired energy vegetation, making them the highest two nations in East Asia, accounting for 80% of the area’s complete.

These figures come from the World Power Monitor international fuel plant tracker, which was not too long ago up to date to cowl greater than 9,000 items, together with almost 700GW of recent capability below improvement all over the world.

But worldwide fuel costs are at the moment at file ranges, at the same time as the fee competitiveness of renewables continues to enhance. This presents a chance for the likes of China and South Korea, which might keep away from a big construct out of fuel and “leapfrog” to cheaper renewables.

In accordance with the most recent information from thinktank TransitionZero, the levelised price of power (LCOE) from renewables plus storage in South Korea and China is nicely under the price of gas-fired energy.

Each nations might reap the benefits of this present price benefit to steer their energy improvement plans towards extra renewables.

Fuel tracker

In 2020, World Power Monitor launched its World Fuel Plant Tracker, as a companion to the long-running coal plant equal. The tracker is designed to catalogue fuel items with capacities of fifty megawatts (MW) or extra (20MW or extra within the European Union and the UK) and, following our newest replace, it now accommodates greater than 1,831GW of operational fuel energy capability in 130 nations throughout the globe.

The tracker additionally covers one other 692GW of recent capability below improvement, which incorporates fuel vegetation which were introduced, have entered formal planning and are thought-about in pre-construction, or are in building.

Whereas nearly all of current fuel energy capability is in North America, SE Asia and East Asia lead when it comes to in-development capability. Throughout the East Asia area, the overwhelming majority of the 141GW of deliberate fuel capability is in two nations, particularly China (93GW) and South Korea (20GW), as proven within the chart under.

![Capacity of gas power plants in development in East Asia, gigawatts, by country[/caption]](https://www.carbonbrief.org/wp-content/uploads/2022/08/Capacity-of-gas-power-plants-in-development-in-East-Asia-gigawatts-by-country.png)

Capability of fuel energy vegetation in improvement in East Asia, gigawatts, by nation. Supply: World Power Monitor international fuel plant tracker. Chart by Carbon Temporary utilizing Highcharts.

On the similar time, each nations have pledged to succeed in net-zero emissions by mid-century, with South Korea focusing on 2050 and China aiming for “carbon neutrality” by 2060.

Levelised prices

There have been vital shifts within the relative competitiveness of electrical energy from fuel and renewables, as wind, photo voltaic and storage prices have continued their dramatic decline and – previously 12 months – as worldwide fuel costs have soared.

Evaluation from thinktank TransitionZero has in contrast these options on the idea of the levelised price of power (LCOE), which it defines as “the common complete prices of constructing and working an influence plant, based mostly on per unit of electrical energy generated over its assumed lifetime”.

For fuel energy, this represents the worth per megawatt hour ($/MWh) at which mission prices may be recovered and buyers can obtain a minimal price of return – often called the “hurdle price” – on the capital and lifelong operational prices of the plant. This consists of the mounted prices of constructing and sustaining the plant, in addition to the short-run marginal price of shopping for gasoline and working it.

For utility-scale photo voltaic or onshore wind with storage, LCOE is the worth ($/MWh) wanted to recuperate mission prices and attain a required hurdle price on funding. The methodology assumes a battery with half the capability of the paired renewable supply, able to discharging for 4 hours. For instance, a ten megawatt (MW) photo voltaic web site would have a 5MW battery holding 20MWh.

(The detailed methodology from TransitionZero is obtainable on-line.)

The evaluation reveals that in South Korea, the LCOE of photo voltaic plus storage is at the moment $120/MWh (pink line within the determine under), as in comparison with $134/MWh for fuel (black line).

![Levelised cost of energy from renewables plus storage and from gas in South Korea[/caption]](https://www.carbonbrief.org/wp-content/uploads/2022/08/Levelised-cost-of-energy-from-renewables-plus-storage-and-from-gas-in-South-Korea.png)

Levelised price of power from renewables plus storage and from fuel in South Korea, $ per megawatt hour. Supply: TransitionZero. Chart by Carbon Temporary utilizing Highcharts.

Together with its greater than 19GW of deliberate new fuel capability, South Korea has round 20GW of wind and photo voltaic capability already in operation, which collectively generated 5% of its complete electrical energy technology in 2021. That is nicely under the international common of 10%, in addition to under different main Asian nations corresponding to India (8%) and Japan (10%).

China has seen fast progress within the adoption of renewables. In 2021, the nation produced 12% of its electrical energy from wind and photo voltaic and this is because of attain almost 20% in 2025.

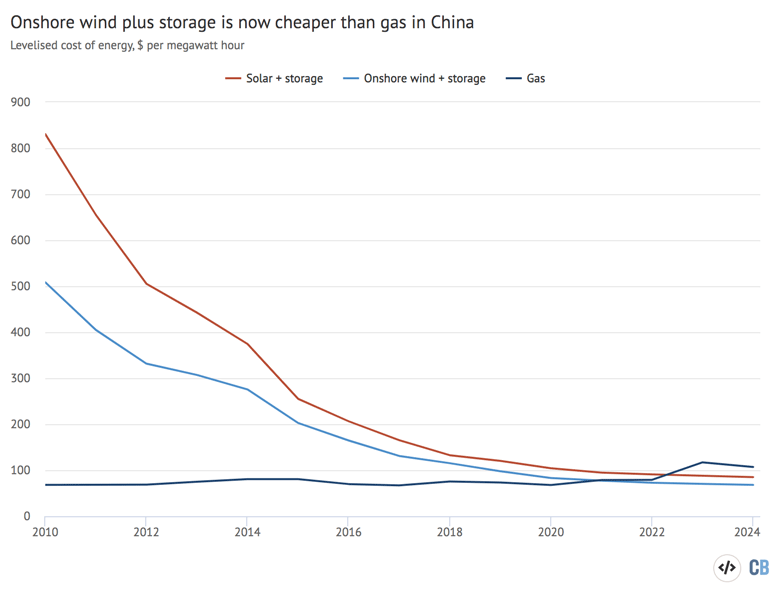

For China, the TransitionZero evaluation reveals that onshore wind with storage at the moment prices $73/MWh, in contrast with $79/MWh for fuel. Its figures counsel photo voltaic with storage may also turn out to be cheaper than fuel by subsequent 12 months, because the chart under reveals.

Levelised price of power from renewables plus storage and from fuel in China, $ per megawatt hour. Supply: TransitionZero. Chart by Carbon Temporary utilizing Highcharts.

Improvement plans

With renewables plus storage now cheaper than fuel, South Korea and China have an economical second to revisit their energy improvement plans.

Investing in renewables as an alternative of fuel wouldn’t solely save each nations cash, however would additionally minimise the danger of being locked in to fuel infrastructure commitments for a protracted time period.

Furthermore, the worldwide fossil gasoline market is at current extremely unstable and topic to excessive worth variation attributable to accidents, climate occasions and geopolitical shifts that may ripple all over the world.

For instance, the latest explosion at one of many world’s largest suppliers of liquefied pure fuel (LNG) in Freeport, Texas, resulted in a 4% improve in futures costs for LNG in East Asia. And a July heatwave in Japan pushed up energy demand and LNG costs, as utilities sought further gasoline.

Geopolitical conflicts even have a bearing on the provision and worth of fossil fuels, with the continuing battle in Ukraine illustrating clearly how the commerce in power may be “weaponised”.

In distinction, indigenous renewables can guarantee steady power costs which can be far much less uncovered to – even when not totally immune from – the vagaries of geopolitics.

Lastly, there may be additionally a chance price. If South Korea and China proceed investing in fuel, they could have fewer assets to put money into the renewables they should meet their local weather targets.

Sharelines from this story