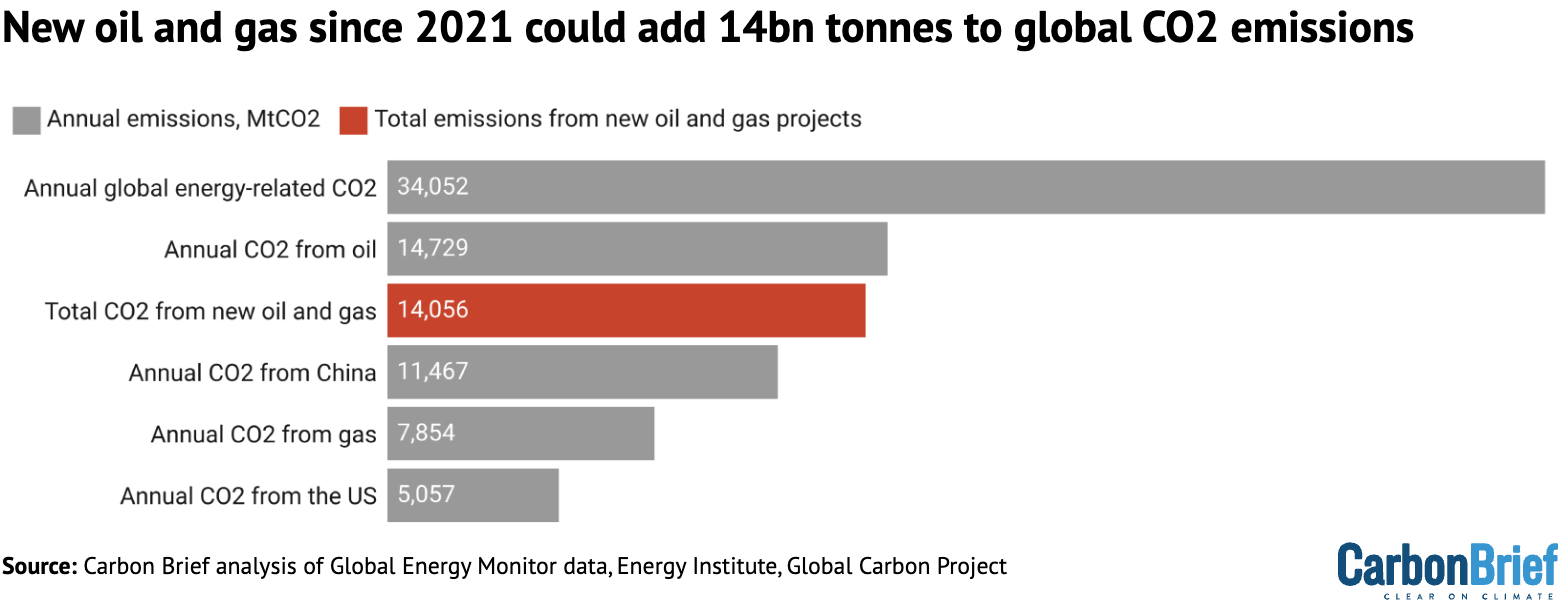

Burning all of the oil and gasoline from new discoveries and newly accepted initiatives since 2021 would emit no less than 14.1bn tonnes of carbon dioxide (GtCO2), in response to Carbon Temporary evaluation of World Vitality Monitor (GEM) information.

This could be equal to greater than a complete yr’s value of China’s emissions.

It consists of 8GtCO2 from new oil and gasoline reserves found in 2022-23 and one other 6GtCO2 from initiatives that had been accepted for improvement over the identical interval.

These have all gone forward because the Worldwide Vitality Company (IEA) concluded, in 2021, that “no new oil and gasoline fields” can be required if the world had been to restrict world warming to 1.5C .

Since then, world leaders gathering on the COP28 summit on the finish of 2023 have additionally agreed to “transition away from fossil fuels”.

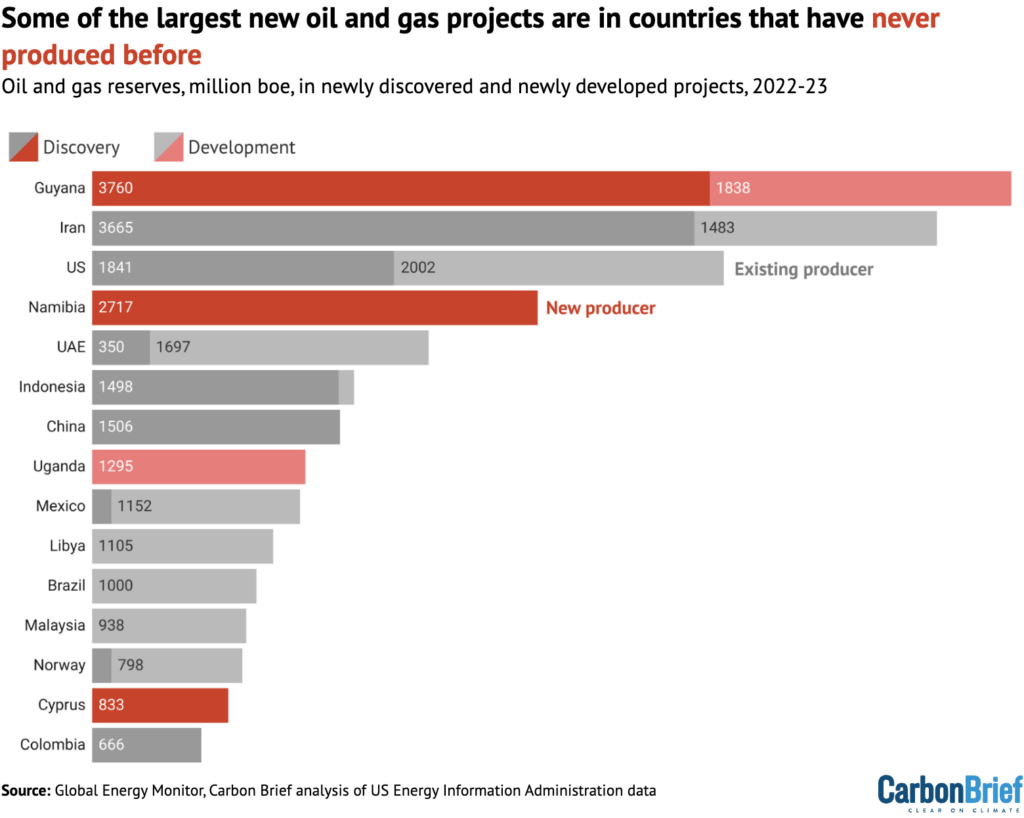

Regardless of this, nations resembling Guyana and Namibia are rising as fully new hotspots for oil and gasoline improvement. On the similar time, main historic fossil-fuel producers, such because the US and Iran, are nonetheless going forward with massive new initiatives.

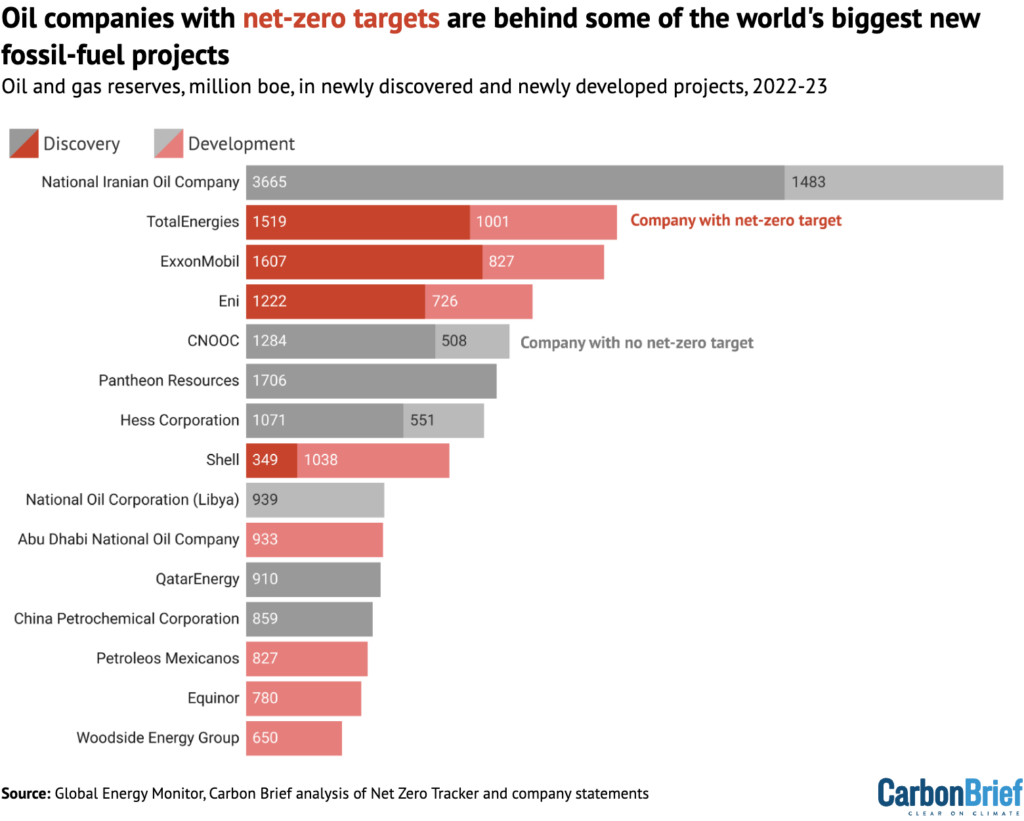

Moreover, oil majors resembling TotalEnergies and Shell which have made public commitments to local weather motion, are among the many greatest gamers investing in new oil and gasoline extraction around the globe.

Extra oil, extra CO2

In 2021, the IEA issued its first “net-zero roadmap”, setting out a pathway for the world to restrict warming to 1.5C. The influential company concluded that:

“Past initiatives already dedicated as of 2021, there aren’t any new oil-and-gas fields accepted for improvement in our pathway.”

This assertion has change into a rallying cry for campaigners and leaders pushing for a section out of fossil fuels.

The IEA has since clarified that there can be no want for brand new oil and gasoline developments if the world will get on monitor for 1.5C. It has additionally barely softened its language, by permitting for brand new oil and gasoline initiatives with a “short-lead time” inside its 1.5C situation.

But it has additionally warned of the danger of “overinvestment” in new developments, noting that present spending is “virtually double” what can be wanted beneath its 1.5C pathway.

In any case, the IEA’s message has been extensively ignored by oil and gasoline firms, which have continued to seek for new extraction alternatives.

In its new world oil and gasoline extraction tracker, GEM identifies 50 new websites found in 2022 and 2023, after the IEA issued its preliminary net-zero roadmap. The oil and gasoline reserves from these initiatives quantity to twenty.3m barrels of oil equal (Mboe).

The tracker additionally recognized an additional 45 initiatives which have reached “ultimate funding resolution” (FID) because the IEA’s roadmap, with an additional 16Mboe of reserves. FID is the purpose at which firms resolve to maneuver forward with a undertaking’s development and improvement.

If all of the oil and gasoline within the newly found reserves is burned within the coming years, an additional 8GtCO2 can be launched into the ambiance, in response to Carbon Temporary evaluation. Including the reserves found between 2022-23 brings this complete to 14.1GtCO2.

That is equal to greater than one-third of the CO2 emissions from world power use in 2022, or all of the emissions from burning oil that yr, as proven within the chart beneath.

These findings are in keeping with mounting proof that each firm and authorities plans for fossil fuels should not aligned with their very own local weather objectives.

In keeping with the newest UN Atmosphere Programme “manufacturing hole” report, firms are planning for gasoline and oil manufacturing that’s 82% and 29% increased, respectively, than can be wanted in a 1.5C pathway.

The remaining “carbon price range” of emissions that may be launched whereas retaining a 50% probability of limiting warming to 1.5C is simply 275GtCO2, in response to the World Carbon Finances consortium of scientists. Burning the entire contents of the brand new oil and gasoline schemes recognized by GEM would burn up 5% of this remaining price range.

Furthermore, the GEM report factors out that new initiatives take, on common, 11 years to start out producing important quantities of oil and gasoline. Which means that most is not going to enter manufacturing till the 2030s.

By this level, in accordance to the IEA, fossil-fuel demand would have fallen by “greater than 25%” if the world will get on to a 1.5C-compliant pathway.

GEM additionally notes that its evaluation probably underestimates the dimensions of latest fossil gas developments. It excludes smaller websites and people the place the dimensions has not been publicly introduced, resembling new gasoline fields found in Saudi Arabia in 2022.

The IEA up to date its net-zero situation in 2023 to mirror the continued enlargement of fossil-fuel initiatives since its earlier report. It said that:

“No new lengthy lead time typical oil and gasoline initiatives should be accepted for improvement.”

It added that falling demand for fossil fuels “might also imply that quite a lot of excessive value initiatives come to an finish earlier than they attain the top of their technical lifetimes”, once more if the world will get onto a 1.5C pathway.

To mirror the IEA’s new language round avoiding “lengthy lead time” and “typical” initiatives, GEM excludes expansions of present initiatives and “unconventional” websites from its evaluation. The report notes that together with them would roughly quadruple the dimensions of the reserves that reached a FID in 2022-23.

Oil majors

Many oil firms have made it clear that they don’t intend to wind down their fossil-fuel operations within the close to future.

That is true even for those who have made commitments to local weather motion, resembling Shell and TotalEnergies. (Some oil majors have additionally watered down their pledges in latest months.)

Because the chart beneath reveals, most of the firms with the most important share of latest oil and gasoline schemes have additionally introduced net-zero targets.

The highest rankings are dominated by publicly traded oil majors, resembling ExxonMobil, and nationwide firms, such because the Abu Dhabi Nationwide Oil Firm (ADNOC) – which is led by COP28 president Sultan Al Jaber. Saudi Aramco, the world’s largest oil firm, is lacking from the GEM tracker, probably because of the lack of knowledge from Saudi Arabia.

The emissions that might consequence from new gasoline fields run by the state-owned Nationwide Iranian Oil Firm alone quantity to 1,700MtCO2, in response to Carbon Temporary evaluation. That is increased than the annual carbon footprint of Brazil.

In the meantime, oil and gasoline in new initiatives being developed by TotalEnergies and ExxonMobil might generate roughly 1,000MtCO2 – equal to Japan’s annual complete – for every firm.

On the latest CERAWeek business convention, many oil and gasoline business leaders argued towards a transition to cleaner types of power. For instance, Saudi Aramco chief govt Amin Nasser informed attendees: “We should always abandon the fantasy of phasing out oil and gasoline.”

As firms proceed looking for extra oil and gasoline, executives have constantly emphasised that demand for fossil fuels, relatively than manufacturing, is the issue.

Most not too long ago, in an interview with Fortune, ExxonMobil chief govt Darren Woods positioned the blame on the general public, who he mentioned “aren’t keen to spend the cash” on low-carbon alternate options.

New nation ‘hotspots’

New nations, primarily within the world south, are opening up as “world hotspots” for oil and gasoline initiatives, in response to GEM.

Notably, Guyana is set to have the best oil manufacturing progress by way of to 2035. Over the previous two years, it has already been the positioning of extra new oil and gasoline discoveries than another nation. Namibia has additionally opened up as a significant new frontier in fossil-fuel extraction.

The chart beneath reveals how nations which have not too long ago been focused for oil and gasoline exploration, now make up a big portion of latest discoveries and developments.

The enlargement of oil and gasoline manufacturing within the world south is a extremely politicised matter.

Many African leaders, specifically, argue that their nations are entitled to use their pure assets as a way to deliver advantages to their individuals, as global-north nations have carried out. At COP28, African Group chair Collins Nzovu said that oil and gasoline had been “essential for Africa’s improvement”.

(It’s value noting that, in response to GEM’s evaluation, firms based mostly within the world north resembling ExxonMobil, Hess Company and TotalEnergies personal many of the reserves within the new global-south initiatives.)

In the meantime, rich oil producers such because the US, Norway and the UAE justify their continued fossil-fuel extraction by saying their manufacturing emissions are comparatively low. Others, such because the UK, argue that they should exploit home reserves to protect their power safety.

Even in a 1.5C situation, the IEA nonetheless features a considerably decreased quantity of oil and gasoline use in 2050. Most of it goes in the direction of making petrochemicals and producing hydrogen gas.

Nonetheless, in final yr’s report on the place of the oil and gasoline business within the net-zero transition, the company additionally emphasises that this doesn’t imply everybody can proceed producing.

“Many producers say they would be the ones to maintain producing all through transitions and past. They can not all be proper,” it concludes.

Sharelines from this story