A file variety of initiatives have been secured within the UK’s newest public sale for brand spanking new renewable capability, following modifications launched by the federal government.

Greater than 130 wind, photo voltaic and tidal power initiatives secured funding within the newest spherical of the “contracts for distinction” (CfD) scheme, amounting to 9.6 gigawatts (GW) of capability.

That is thrice larger than the quantity secured final 12 months. It is usually a brand new capability file, if wind energy initiatives from 2022 that had been subsequently cancelled or scaled again are excluded.

The public sale comes after final 12 months’s failure to contract any new offshore wind initiatives. This 12 months, 4.9GW of offshore wind was confirmed, in addition to one 400MW floating offshore wind mission, which would be the world’s largest when constructed.

Opposite to deceptive newspaper studies, one analyst instructed Carbon Temporary the schemes would lower client payments by “growing the supply of low cost, low-carbon energy”.

Nevertheless, the power sector has warned {that a} “massive step-up” will likely be required with a view to construct sufficient renewables for the brand new Labour authorities’s goal of a clear energy system by 2030.

Earlier evaluation from business group Vitality UK reveals reaching this goal would wish an unprecedented fourfold enhance in offshore wind capability being permitted at subsequent 12 months’s public sale.

Return of offshore wind

The federal government’s CfD scheme gives fixed-price contracts to low-carbon electrical energy turbines by way of a “reverse public sale” course of, which is now held yearly.

Initiatives bid towards one another to safe contracts for the electrical energy they’ll generate. The profitable bidders get a CfD to promote electrical energy at a set “strike worth”.

If the market pays lower than this quantity, a levy is added to payments to make up the distinction – and if market costs are larger, then the mission pays the distinction again to shoppers.

Final 12 months’s fifth allocation spherical (AR5) noticed no offshore wind initiatives awarded contracts for the primary time because the CfD scheme was launched in 2015.

Simply 3.7GW of whole renewables capability was secured, which was primarily made up of photo voltaic (1.9GW) and onshore wind (1.7GW).

That end result had adopted vital financial pressures within the business on account of larger commodity costs, provide chain constraints and better borrowing prices.

In response to the Worldwide Vitality Company (IEA), offshore wind funding prices rose 20% final 12 months, even earlier than bearing in mind the rise in rates of interest. It cited one offshore wind mission within the UK that had been cancelled after general prices rose by 40%.

This was the Norfolk Boreas windfarm, which had gained a contract within the 2022 public sale.

To be able to keep away from repeating final 12 months’s failure on offshore wind, quite a few modifications had been made forward of this 12 months’s public sale. This included restoring offshore wind to a separate funding “pot”, relatively than combining it with photo voltaic and onshore wind.

Extra importantly, the “finances” for the public sale was raised considerably in November 2023 and the worth cap for offshore wind was elevated by 66%, from £44 per megawatt hours (MWh) to £73/MWh. (Notice that CfD auctions are reported in 2012 costs.)

Past offshore wind, worth caps had been additionally raised for different applied sciences, together with photo voltaic by 30% (from £47/MWh to £61/MWh), geothermal by 32% (from £119/MWh to £157/MWh) and tidal by 29% (from £202/MWh to £261/MWh).

Subsequently, in late July the newly elected Labour authorities once more raised the CfD public sale “finances”. This introduced the ultimate general “finances” for the sixth allocation spherical (AR6) to £1.56bn, a rise of £530m on AR5.

(Notice that the “finances” is a notional restrict on the quantity of CfD levies that may be added to client electrical energy payments. It doesn’t come from authorities coffers and doesn’t translate immediately into an equal enhance in client prices, as a result of CfD initiatives additionally scale back wholesale electrical energy costs, which make up the majority of payments.)

Throughout the elevated “finances” was an additional £65m for “pot 1” applied sciences, primarily photo voltaic and onshore wind, and £165m for “pot 2” for applied sciences equivalent to floating offshore wind. There was additionally an additional £300m for “pot 3”, that means fixed-foundation offshore wind initiatives may bid as much as a complete of £1.1bn.

Moreover, one vital change was the allowance of “permitted discount” initiatives in AR6.

Underneath permitted discount, as much as 25% of the capability from a mission that has beforehand been awarded a CfD will be withdrawn, with the choice of submitting it once more at future auctions.

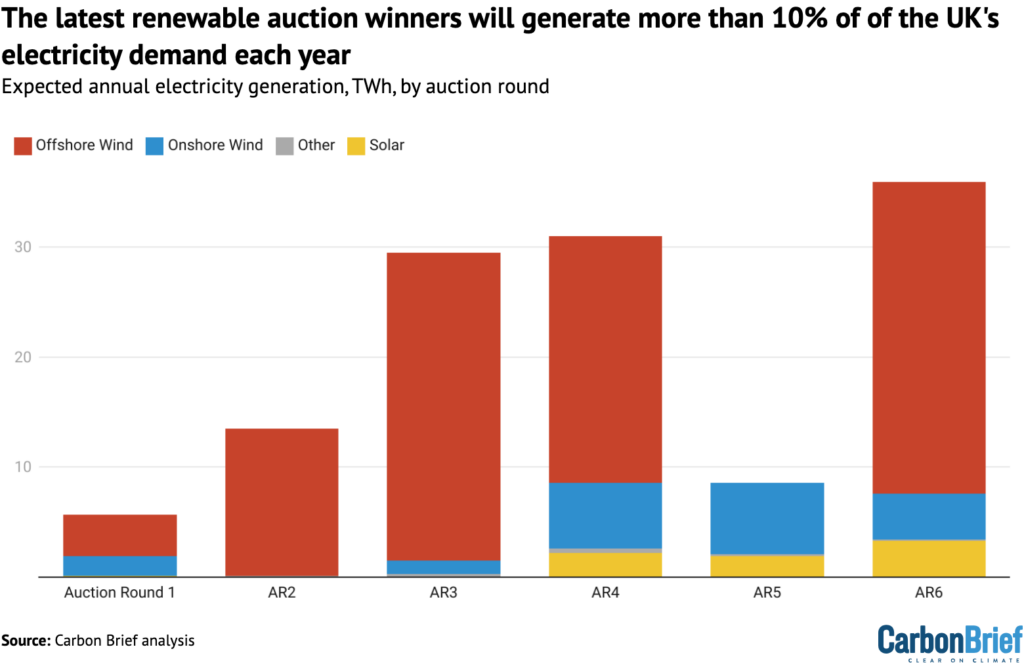

Following these modifications to the public sale framework, AR6 secured 9.6GW of capability, throughout a file 131 initiatives. This represents a threefold enhance from the earlier public sale spherical. Because the chart beneath reveals, as soon as the 2022 initiatives which have since been withdrawn are excluded it additionally represents a file quantity of renewable capability.

The 9.6GW of capability secured within the public sale contains 3.4GW of new-build offshore wind, at a strike worth of £58.87/MWh. This was throughout two initiatives, Ørsted’s Hornsea Undertaking 4 (2.4GW) and ScottishPower’s East Anglia 2 (1.0GW).

Moreover, 1.6GW of beforehand submitted offshore capability was awarded contracts as a part of the “permitted discount” course of. This was break up throughout seven initiatives, which secured a strike worth of £54.23/MWh.

The “permitted discount” course of was launched, partly, on account of round 3GW of offshore wind initiatives – together with the Norfolk Boreas windfarm – which gained contracts in allocation spherical 4 (AR4) in 2022 subsequently being cancelled or contracted.

Anticipating the “permitted discount” course of in December 2023, world wind large Ørsted had introduced a ultimate funding choice for the two.9GW Hornsea 3.

It had initially secured a CfD in 2022 at a strike worth of £37.35/MWh. On this 12 months’s public sale Hornsea 3 secured a CfD for the share resubmitted at £54.23/MWh.

Writing on LinkedIn, Alex Asher, marketing consultant at Cornwall Perception famous the dimensions and worth of the permitted discount in pot 3. He wrote:

“Round a 3rd of the capability, 1.5GW, coming from permitted reductions is critical, and a £4/MWh cheaper price will be seen as a possible win for shoppers, however will also be seen as a excessive worth for property which have already got a specific amount of growth coated. Will probably be attention-grabbing to see how permitted reductions are utilized in AR7 and past.”

The public sale additionally secured 3.3GW of photo voltaic capability throughout 93 initiatives and 1.0GW of onshore wind throughout 22 initiatives. This contains one onshore wind mission in England, the place the know-how had been successfully “banned” for years underneath the earlier Conservative authorities

Collectively, these three applied sciences had been awarded contracts at over 18% beneath their “administrative strike costs” – the utmost worth that builders can bid into the public sale. In response to consultants Aurora Vitality this displays“robust market engagement” with the public sale, leading to elevated competitors between bidders.

The public sale additionally resulted in a contract for the biggest floating offshore wind mission on the planet, the 0.4GW GreenVolt scheme, which secured a strike worth of £139.93/MWh. The mission is double the scale of Europe’s whole put in floating offshore wind capability.

Six tidal initiatives, with a complete capability of 28 megawatts (MW), secured contracts with a strike worth of £172/MWh. The federal government says that is “constructing on the UK’s world main place, with slightly below half of the world’s operational tidal stream capability being located in UK waters”.

As soon as constructed, these initiatives are anticipated to generate some 36 terawatt hours (TWh) of electrical energy every year – greater than 10% of the UK’s present demand, as proven within the determine beneath. That is equal to 1.5 instances the anticipated output of the Hinkley C new nuclear plant, which is underneath building and now on account of come on-line in 2031.

In whole, the renewable initiatives contracted within the first six CfD public sale rounds will generate practically 125TWh per 12 months by 2029, practically half of present UK demand.

Altering costs

Regardless of continued will increase in strike costs within the CfD from the file lows seen in 2022, renewables stay among the UK’s least expensive methods to supply new electrical energy era.

As well as, the entire renewable contracts had been awarded at beneath the technology-specific worth caps on this 12 months’s public sale.

Because of this of the £1.56bn “finances” for the public sale, round £1.29bn was allotted, in response to Cornwall Perception.

Talking to Carbon Temporary, Martin Younger, business marketing consultant at Aquaicity says the estimated finances impression for offshore wind is £870m, in comparison with the £1.11bn on provide. For “rising applied sciences” in funding pot 2, the estimated finances impression of the contracts awarded is £228m out of the £275m that was on provide.

Younger provides:

“Functions obtained for every pot had been above budgets for every pot, suggesting that there have been unsuccessful initiatives searching for larger strike costs that would not be accommodated with the finances buildings of every pot.”

The vast majority of these unsuccessful initiatives had been offshore wind.

Offshore wind strike costs this 12 months had been £54/MWh – some 46% above the record-low £37/MWh seen in 2022, which got here earlier than the sharp enhance in prices linked to the worldwide power disaster and rising rates of interest.

Photo voltaic costs additionally elevated to £50MWh, up from £46/MWh in 2022 and £47/MWh in 2023. Onshore wind, in the meantime, cleared at £51/MWh, barely beneath the £52/MWh achieved in 2023 however nicely above the £42/MWh seen in 2022.

Earlier this 12 months, Cornwall Perception predicted that wholesale electrical energy costs – a proxy for the associated fee to gasoline and function an already-built gas-fired energy station – would sit at £82/MWh on common for 2024/25, and £84/MWh for 2025/26.

In response to Aurora Vitality Analysis, wholesale costs averaged £93/MWh in 2023 and £64/MWh in 2024 to this point.

CfD contracts are expressed in 2012 costs, however even when adjusted for inflation new-build offshore wind, onshore wind, and photo voltaic are £82/MWh, £71/MWh and £70/MWh in right this moment’s cash.

Whereas this 12 months’s clearing strike costs might sit barely above wholesale electrical energy costs for 2024, the comparability between wholesale energy costs for 2024 and the costs awarded to CfD initiatives is “barely misleading” as Pranav Menon, analysis affiliate at Aurora explains to Carbon Temporary.

Crucially, Menon says that the initiatives secured by the public sale will scale back payments. He says:

“In the end, the price of the CfD contracts awarded will rely upon how costs look within the years these property are operational and subsidised, ie between 2026 and 2045. General, on condition that wholesale costs are anticipated to drop as extra intermittent renewables connect with the grid, we do count on the whole value of AR6 contracts to be larger than current market costs suggest.

“Nevertheless, deploying this capability in the end lowers prices to shoppers by growing the supply of low cost, low-carbon energy and is vital to lowering energy sector emissions.”

Menon’s evaluation immediately contradicts deceptive protection within the Each day Telegraph and the Each day Mail, each of which reported that the public sale would enhance payments.

The Mail mentioned that the brand new renewable initiatives secured within the public sale would add £50 to payments, citing free-market thinktank the Institute of Financial Affairs and climate-sceptic foyer group Web Zero Watch. These teams, in flip, relied on a weblog written by a retired IT marketing consultant months earlier than the public sale end result was introduced.

In an article trailed on the newspaper’s frontpage and quoting John Constable, the “power editor” of Web Zero Watch’s mum or dad organisation the International Warming Coverage Basis, the Each day Telegraph mentioned the public sale would add £150 to payments.

Each newspapers’ figures are improper as a result of, amongst a string of errors, they assume that the public sale “finances” interprets immediately into an impression on client payments. That is incorrect.

Shopper payments are made up of wholesale electrical energy prices, levies to assist CfDs and different authorities insurance policies, in addition to quite a few different components. Whereas CfD initiatives immediately have an effect on levies, additionally they not directly scale back wholesale costs.

Adam Bell, director of coverage at consultancy Stonehaven tells Carbon Temporary that trying on the CfD “finances” alone is just not a significant method to calculate the impression on payments. He explains:

“The one significant comparability is between a system that has these further [wind and solar] initiatives and a system that doesn’t. So that you add the price of CfD funds and subtract decrease wholesale costs that come up from having extra zero marginal value era.”

General, evaluation from Aurora reveals that payments are possible to be decrease if the UK reaches the federal government’s 2030 goal for clear electrical energy by constructing extra wind and photo voltaic initiatives, than if it continues to depend on bigger quantities of costlier and unstable gas-fired energy.

Certainly, wholesale energy costs are predicted to remain above £80/MWh on common out to 2030, in response to Cornwall Perception, that means the newly contracted schemes will generate energy at or beneath anticipated wholesale costs by the point they begin working.

‘Massive step-up’ wanted

After final 12 months’s failure to safe any new offshore wind capability, commerce physique Vitality UK warned of “severe dangers” that the then-Conservative authorities can be unable to fulfill its purpose of reaching 50GW of offshore wind capability by 2030.

Since then, there was an election and a brand new Labour authorities, with a extra formidable goal of a net-zero energy system by 2030. This contains a new purpose of deploying 55GW of typical offshore wind by 2030, plus 5GW of floating offshore wind.

There’s at the moment 15GW of typical offshore wind capability working within the UK. This might want to extend by greater than 3.5 instances over the subsequent six years to fulfill the brand new goal.

It takes a number of years for a mission to maneuver from public sale to the purpose at which it’s producing electrical energy. Because of this the auctions this 12 months and subsequent 12 months are considered by Vitality UK as the ultimate ones at which initiatives can realistically be secured in time for the 2030 goal.

Labour’s revised CfD finances elevated the quantity of offshore wind capability secured this 12 months, with 4.9GW contracted in addition to 400MW of floating offshore wind.

Nevertheless, Vitality UK evaluation in July concluded that the upcoming two auctions – this 12 months and subsequent 12 months – “should ship 26GW of recent capability”. This implies subsequent 12 months’s public sale would now must safe 21GW of typical offshore wind capability to hit the 2030 purpose.

Beforehand, the commerce physique had said that it might be “unrealistic to count on that 21GW may very well be achieved from only one CfD public sale spherical”. It pointed to sensible points equivalent to provide chain constraints and the supply of expert employees.

Because the chart beneath reveals, reaching this stage would require an unprecedented fourfold enhance in offshore wind capability secured in a single public sale.

Whereas the knowledgeable commentary on the brand new public sale outcomes was broadly constructive, a few of it additionally mirrored these considerations about subsequent 12 months’s public sale.

Aurora’s Menon mentioned in an emailed assertion that “extra progress is important” to fulfill the 60GW purpose, as subsequent 12 months “would be the ultimate alternative to safe the remaining capability wanted”.

In the meantime, Dan McGrail, chief govt of the commerce physique RenewableUK, mentioned in a press release:

“The federal government has set a world-leading clear energy mission for 2030 and to fulfill that can want a giant step-up from right this moment.”

Sharelines from this story