Fossil gasoline use will peak inside 5 years, says the World Vitality Outlook 2022 from the Worldwide Vitality Company (IEA).

The 524-page outlook says the worldwide vitality disaster and Russia’s conflict have “turbo-charged” the shift away from fossil fuels.

For the primary time, coal, oil and gasoline will every peak, even when nations fail to satisfy their local weather pledges. The report says this will likely be a “pivotal second” in historical past.

The findings pour chilly water on “mistaken and deceptive” concepts across the international vitality disaster. IEA govt director Dr Fatih Birol says the “clear vitality transition” is the “greatest manner out” of the disaster. This could be a “historic turning level” for local weather motion, he provides, slightly than a setback.

Nations are shifting to impress warmth and transport extra rapidly than they have been final yr, the IEA says. It provides that “clear vitality…is the large progress story of this outlook”.

International vitality demand progress will “nearly completely” be met by renewables. Furthermore, international photo voltaic capability will climb 18% greater by 2030 than anticipated final yr – and wind 14%.

International carbon dioxide (CO2) emissions at the moment are set to peak by 2025 on the newest, the outlook says. In consequence, the world would heat by 2.5C this century, barely lower than the two.6C the IEA anticipated final yr.

Nations have additionally boosted the ambition of their local weather pledges. These would now restrict warming to 1.7C if met in full, slightly than 2.1C said final yr.

Nevertheless, it’s “simpler to make pledges than to implement them”, the IEA says. There may be nonetheless a “lengthy technique to go” to align motion with the 1.5C goal.

The outlook additionally raises issues over rising geopolitical tensions and thousands and thousands of individuals shedding entry to vitality resulting from fossil gasoline worth inflation. It says the shift away from the “fragil[e] and unsustainab[le]” vitality system constructed on fossil fuels calls for brand spanking new approaches to vitality safety.

(See Carbon Transient’s protection of earlier IEA world vitality outlooks from 2021, 2020, 2019, 2018, 2017, 2016 and 2015.)

World vitality outlook

The IEA’s annual World Vitality Outlook (WEO) is revealed each autumn. It’s broadly considered one of many most influential annual contributions to the local weather and vitality debate.

The outlook explores a variety of eventualities, representing completely different doable futures for the worldwide vitality system. These are developed utilizing the IEA’s “International Vitality and Local weather Mannequin”.

The 1.5C-compatible “net-zero emissions by 2050” (NZE) situation, launched final yr, is now firmly established within the combine. This situation reveals a “slender however achievable” path to the 1.5C goal.

The NZE takes its place alongside the “said insurance policies situation” (STEPS), representing “present coverage settings”. For this situation, the IEA “do[es] not assume that…targets are met until…backed up with element on how they’re to be achieved”.

Within the “introduced pledges situation” (APS), the IEA provides governments “the advantage of the doubt”. All pledges, irrespective of how aspirational, are assumed to be met on time and in full.

Annex B of the report breaks down the insurance policies and targets included in every situation. In impact, the IEA is judging the seriousness of every goal and whether or not it will likely be adopted by.

For instance, the provisions of the lately legislated US Inflation Discount Act are included within the STEPS. However the US goal to chop emissions to 50-52% beneath 2005 ranges by 2030 is just met underneath the APS.

For the EU, new coal phaseout commitments and up to date nationwide vitality and local weather plans are in STEPS. Full implementation of the RePowerEU bundle, nevertheless, is just within the APS.

In the identical manner, China’s 14th five-year plan and India’s renewable targets are inside STEPS. Their long-term targets to develop into carbon impartial by 2060 and 2070, respectively, are within the APS.

One corollary of that is that the STEPS is all however assured to incorporate stronger coverage subsequent yr. This improve in ambition over time, as introduced pledges are transformed into said insurance policies, is obvious from the historic report. (See beneath for charts evaluating IEA outlooks over time.)

The NZE was on the coronary heart of final yr’s outlook, talked about way more ceaselessly than the opposite eventualities. This yr, the STEPS retakes a central place within the report. It’s talked about 180 instances per 100 pages, in contrast with 173 for APS and 155 for NZE.

Equally, this yr’s outlook solely mentions “1.5C” half as usually as final yr. In distinction, the report mentions “Russia” 78 instances per 100 pages, practically 5 instances extra usually than in 2021. Different extra frequent phrases embrace “disaster” (35 instances per 100 pages, up from 4) and “inflation” (14, up from 1).

International vitality disaster

The shift in emphasis on this yr’s outlook comes for apparent causes. The world is in its “first really international vitality disaster”, with “profound” impacts that can reverberate for many years.

The IEA says the disaster was “triggered by Russia’s invasion of Ukraine”. Whereas markets have been already straining final yr, Russia tipped what was a powerful restoration from the pandemic…into full-blown turmoil”. It provides that Europe’s reliance on Russian vitality was a “strategic weak spot”.

Birol makes use of his foreword to present quick shrift to those who search to place the blame elsewhere:

“[T]here’s a mistaken concept that that is by some means a clear vitality disaster. That’s merely not true…When individuals deceptive blame local weather and clear vitality for as we speak’s disaster, what they’re doing – whether or not they imply to or not – is shifting consideration away from the actual trigger: Russia’s invasion of Ukraine.”

The report says there may be “scant proof” that funding in fossil gasoline provides was “stifled” by net-zero targets. It’s also “troublesome to argue” that local weather insurance policies had a job in excessive vitality costs.

Certainly, the IEA says excessive gasoline and coal costs are behind 90% of the rise in international electrical energy costs this yr. By September 2022, the TTF European gasoline benchmark reached 24 instances its worth two years earlier, as proven within the chart beneath.

Durations of excessive fossil gasoline costs “provide sturdy incentives to maneuver away from reliance on these fuels or to make use of them extra effectively, reinforcing the momentum behind vitality transitions”, the IEA says. It might additionally “spur renewed investments in fossil gasoline provide” within the identify of vitality safety.

The steadiness between these two outcomes is a key alternative for governments that would assist – or hinder – hopes of protecting warming beneath internationally agreed targets.

The short-term response has seen governments commit “nicely over $500bn” to guard shoppers. They’ve additionally “rushed to attempt to safe various gasoline provides”, allowed greater use of coal energy, prolonged nuclear plant lifetimes and accelerated renewable tasks, the IEA says.

Regardless of fears of a coal “comeback”, nevertheless, the IEA says “the upside for coal from as we speak’s disaster is momentary”. Nor will it result in greater funding in coal-fired energy vegetation.

Certainly, the IEA says that three-quarters of the extra energy-related funding in 2022, relative to final yr, “is being drawn in direction of clear vitality”.

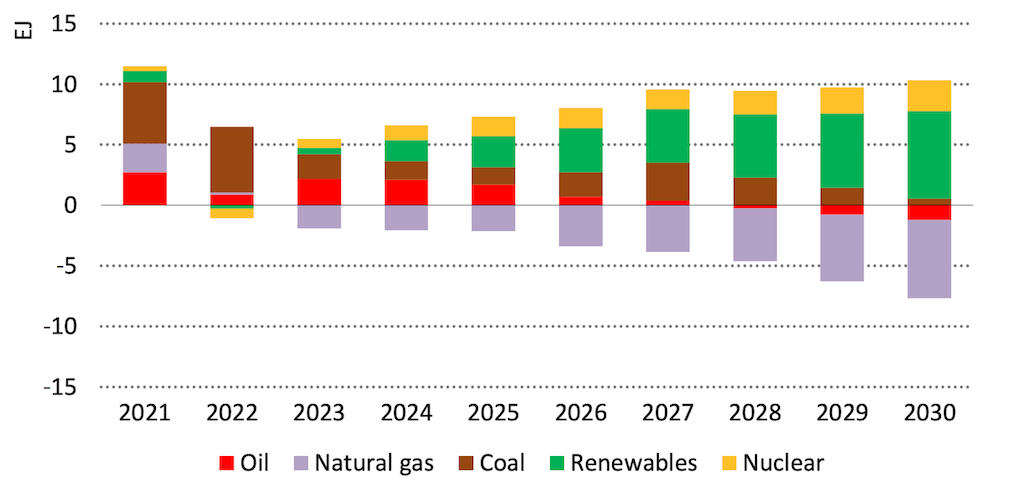

By 2030, coal use will likely be at comparable ranges to these anticipated final yr (brown bars, beneath). Crucially, coal nonetheless faces “structural decline” from the mid-2020s, the IEA provides.

The chart above additionally reveals the influence of medium- and longer-term responses to the disaster. Coverage responses are “fast-tracking the emergence of a clean-energy economic system”, the IEA says.

It says many governments are “trying to speed up structural change” of their vitality programs. It provides examples together with the US Inflation Discount Act, the REPower EU plan, Japan’s Inexperienced Transformation (GX) programme and South Korea’s targets to spice up nuclear and renewables.

Equally, the “huge build-out of unpolluted vitality in China” will trigger a peak in coal and oil use earlier than 2030. And renewables will meet two-thirds of India’s progress in electrical energy demand.

General, the outlook says “the lasting features from the disaster accrue to low-emissions sources, primarily renewables” in addition to “quicker progress with effectivity and electrification”.

(The outlook says: “Demand-side measures have typically obtained much less consideration, however larger vitality effectivity is an important a part of the short- and longer-term response.”)

These features imply that, for the primary time, the IEA now expects fossil gasoline use to peak after which decline. Its outlook factors to a peak in complete fossil gasoline round 2027 – in simply 5 years.

The report explains simply how large a second this decoupling will likely be for the world:

“International fossil gasoline use has risen alongside GDP because the begin of the commercial revolution within the 18th century: placing this rise into reverse whereas persevering with to broaden the worldwide economic system will likely be a pivotal second in vitality historical past.”

This second is the end result of a collection of shifts within the outlook for fossil fuels, proven within the chart beneath.

Earlier than the Paris Settlement in 2015, the IEA anticipated fossil fuels to proceed their historic march upwards (gray line). That progress has been steadily eroded (blue traces), as shifts in authorities coverage, technological progress – and now Russia’s conflict – have boosted clear vitality.

Black line: Historic international demand for fossil fuels, exajoules. Gray and blue traces: The shifting outlook for fossil gasoline progress as insurance policies have advanced since earlier than Paris. Pink and pink traces: The influence of assembly new local weather pledges made since final yr. Yellow traces: What would occur if the world was on a path to staying beneath 1.5C. Supply: Carbon Transient evaluation of IEA World Vitality Outlooks. Chart by Carbon Transient utilizing Highcharts.

The fossil-fuel peak is “emblematic of a shift within the vitality panorama because the Paris Settlement”, the IEA says. After assembly 80% of world vitality demand for many years, insurance policies in place as we speak will guarantee fossil fuels fall to 75% by 2030 and to 60% by 2050.

(The pink line within the chart above signifies that the decline in fossil fuels will likely be even quicker if nations meet their local weather pledges. See: Slender pathway for 1.5C.)

The IEA says for the primary time its outlook consists of separate peaks for coal (“inside the subsequent few years”), oil (“within the mid-2030s”) and gasoline (“by the tip of the last decade”).

The most dramatic change in fortunes since final yr is for gasoline. Final yr, gasoline demand was anticipated to develop 20% by 2050. Now the determine is simply 2%, with 89% of anticipated progress worn out.

The “golden age of gasoline” predicted by the company in 2012 has been “undercut” by the present disaster. Progress has all however evaporated and the “golden age” has come to an finish.

(Field 8.3 on web page 407 of the report asks rhetorically if the golden age is over. Elsewhere, it says Russia’s actions imply the “period of fast progress in pure gasoline demand attracts to a detailed”.)

Whereas excessive fossil gasoline costs have delivered a “big” $2tn windfall for fossil gasoline producers, together with Russia, on the expense of importers equivalent to Europe, the long term story is completely different.

By invading Ukraine and precipitating a world vitality disaster, Russia has misplaced its largest export market in Europe. It faces a “a lot diminished position in worldwide vitality affairs” and there are “appreciable doubts” over a pivot to Asia due to bodily provide constraints.

Russia’s share of world fossil gasoline exports will fall precipitously, notably relative to pre-war expectations. It’s set to lose out on greater than $1tn in export revenues this decade.

Russia faces the prospect of a a lot‐diminished position in worldwide vitality affairs with out its largest export market in Europe. Its set to lose out on greater than USD 1 trillion in export revenues over this remainder of this decade. #WEO22 pic.twitter.com/uZ4J4cXm4U

— Christophe McGlade (@TofMcGlade) October 27, 2022

Though Russia’s actions have “sever[ed] one of many important arteries of world vitality commerce”, the IEA cautions in opposition to funding in new fossil gasoline provides.

First, new provides take years to come back onstream and “are unlikely to supply any reduction within the quick time period”. It says standard oil and gasoline tasks beginning manufacturing since 2010 have taken a median of 19 years from the award of an exploration licence by to first manufacturing. Prolonged manufacturing from present fields is a “higher candidate” for making up any shortfalls, it says.

Second, new provides would generate CO2 emissions that may have to be compensated afterward, making a “clear threat” that the 1.5C goal “strikes out of attain”. The report says:

“[E]missions coming from new tasks…don’t come without cost in local weather phrases…Nobody ought to think about that Russia’s invasion can justify a wave of latest oil and gasoline infrastructure in a world that desires to succeed in net-zero emissions by 2050.”

As a substitute, the report says “clear vitality transitions…characterize one of the best ways out of [the crisis]”. Renewable sources stay the most affordable possibility for brand spanking new electrical energy technology in lots of nations, it says, “even earlier than taking account of the exceptionally excessive costs seen in 2022 for coal and gasoline”.

Increased funding in renewables would “assist[] to cut back electrical energy prices in addition to emissions”, it says. And “vitality safety issues reinforce the rise of low-emissions sources and effectivity”.

Although the outlook doesn’t say so explicitly, the implication is that the fabled “vitality trilemma” is being solved by clear vitality. It explains:

“The environmental case for clear vitality wanted no reinforcement, however the financial arguments in favour of cost-competitive and reasonably priced clear applied sciences at the moment are stronger – and so too is the vitality safety case. This alignment of financial, local weather and safety priorities has already began to maneuver the dial in direction of a greater final result for the world’s individuals and for the planet.”

On account of this alignment between goals, Birol pushes again on the concept the disaster will likely be a setback for local weather motion. He writes in his foreword:

“One other mistaken concept is that as we speak’s disaster is a large setback for efforts to sort out local weather change…In reality, this could be a historic turning level in direction of a cleaner and safer vitality system.”

Slender pathway for 1.5C

In some areas, the world is already making fast progress. The IEA says that international vitality demand progress by the remainder of the last decade will “nearly completely” be met by renewables.

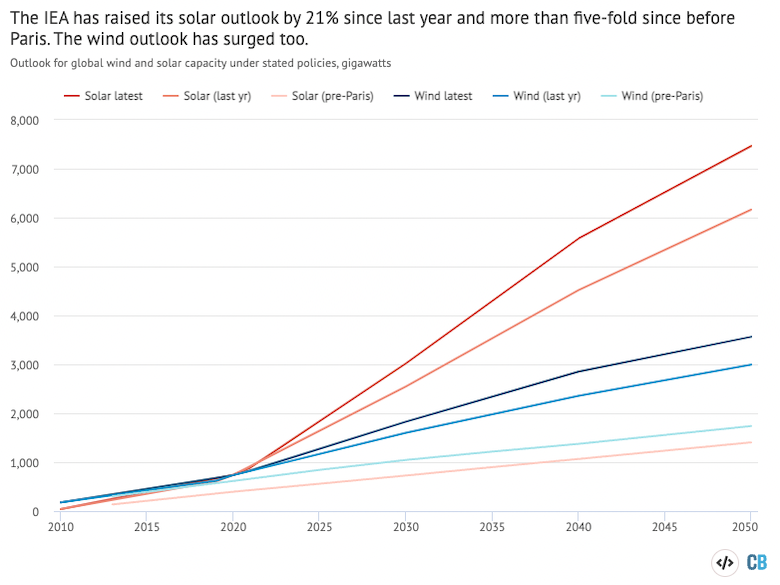

The expansion of wind and photo voltaic is as soon as once more set to surpass earlier expectations. The IEA has raised its outlook for photo voltaic capability progress to 2050 by 21% since final yr. That is proven within the chart beneath because the distinction between the pink and darkish pink traces.

As a substitute of the 6,163 gigawatts (GW) by 2050 anticipated final yr, international photo voltaic capability is now resulting from attain 7,464GW underneath as we speak’s coverage settings, the IEA says. That is greater than 5 instances greater than the 1,405GW anticipated by 2050 underneath pre-Paris coverage (mild pink). Certainly, the world is because of cross the IEA’s 2015 outlook for 2040 of 1,066GW a while this yr.

The chart additionally reveals how the outlook for international wind capability 2050 has surged, from 1,738GW earlier than Paris to 2,995GW final yr and three,564GW this yr, a rise of 19% since 2021 alone.

IEA outlook for international wind (blue) and photo voltaic (pink) capability, gigawatts, underneath said insurance policies earlier than Paris, in 2021 and this yr. Supply: Carbon Transient evaluation of IEA outlooks. Chart by Carbon Transient utilizing Highcharts.

Present wind and photo voltaic progress charges are quicker than required underneath said insurance policies (STEPS) and there are indicators of fast progress elsewhere, the outlook says:

“At the moment’s progress charges for deployment of photo voltaic PV, wind, EVs and batteries, if maintained, would result in a a lot quicker transformation than projected within the STEPS, though this is able to require supportive insurance policies not simply within the main markets for these applied sciences however internationally.”

Furthermore, present progress is enough to make sure that electrical energy provides from fossil fuels will shrink. The report says: “The rise in renewable electrical energy technology is sufficiently quick to outpace progress in complete electrical energy technology, driving down the contribution of fossil fuels.”

It provides that the potential for quicker progress “is gigantic if sturdy motion is taken instantly”. This may require, for instance, “expanded and modernised grids”.

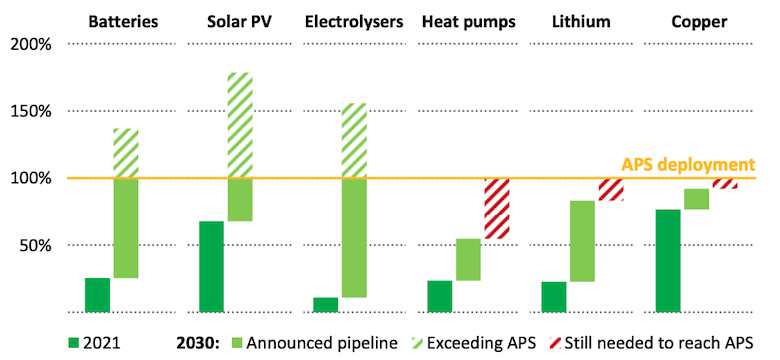

The report additionally seems to be on the manufacturing capability wanted for key clean-energy expertise provide chains. It finds that for photo voltaic, batteries and the electrolysers wanted to make low-carbon hydrogen, sufficient capability is constructed or deliberate by 2030 to satisfy present local weather pledges.

Nevertheless, for warmth pumps, lithium and copper, there’s a shortfall relative to what will likely be wanted.

That is proven within the determine beneath, which compares present capability (darkish inexperienced), the introduced pipeline (mild inexperienced) and the surplus (hatched inexperienced) or shortfall (hatched pink) in capability by 2030, relative to that wanted to satisfy local weather pledges within the APS.

(Field 3.6 of the report compares the dimensions of those provide chains to what can be required by 2030 underneath the 1.5C-compliant NZE situation. It finds that solely photo voltaic has sufficient capability deliberate.)

These clean-energy provide chains are a “big supply” of employment progress, the IEA notes. It provides that there are already extra clean-energy jobs globally than there are in fossil fuels.

The fast progress of some clean-energy applied sciences and the approaching peak in fossil gasoline demand imply that international energy-related CO2 emissions will peak by 2025 on the newest, the IEA says.

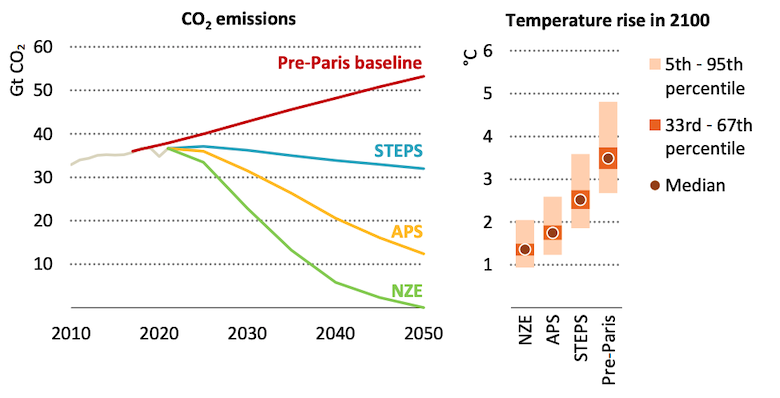

The decline in fossil gasoline use underneath as we speak’s coverage settings would see emissions dropping from 37bn tonnes (GtCO2) in 2021 to 36GtCO2 in 2030 (-1%) and to 32GtCO2 (-13%) by 2050.

These emissions within the STEPS correspond to warming of round 2.5C this century. This improves on the three.5C of warming anticipated underneath said insurance policies earlier than Paris, as proven within the chart beneath. Nonetheless, it stays “removed from sufficient to keep away from extreme impacts from a altering local weather”.

The two.5C of warming underneath as we speak’s coverage settings is a slight enchancment of 0.1C on what was anticipated final yr. There was a a lot bigger enchancment within the ambition of the world’s local weather pledges, proven by the yellow “APS” line within the chart above.

Whereas pledges introduced forward of final yr’s outlook have been sufficient to restrict warming to 2.1C, new pledges over the previous 12 months push that all the way down to 1.7C by 2100. Probably the most vital elements on this shift are new net-zero pledges from India (2070) and Indonesia (2060).

(This yr, for the primary time, the IEA consists of industry- and company-level targets in its APS.)

To fulfill their local weather pledges, nations might want to shut what the IEA calls the “implementation hole”. That is the hole between present insurance policies and the motion wanted to satisfy their targets.

Regardless of the rise in ambition over the previous yr, a big “ambition hole” stays between present pledges and the IEA’s pathway to the 1.5C goal, the NZE. This pathway, up to date since final yr to mirror adjustments prior to now 12 months, “stays slender however achievable”.

Particularly, international emissions elevated in 2021 and are resulting from rise once more this yr. And new fossil gasoline infrastructure constructed since final yr might emit 25GtCO2, if operated till the tip of its lifetime.

NEW

International CO2 emissions will develop by lower than 1% (300MtCO2) this yr, in response to new @IEA evaluation

A a lot bigger 1,000MtCO2 improve has been prevented by main progress of renewables & EVshttps://t.co/sqtQRf5rwR pic.twitter.com/kQAiFwMRql

— Simon Evans (@DrSimEvans) October 19, 2022

This implies the start line for attending to net-zero is greater and the height in emissions later, requiring a steeper decline to stay inside the carbon price range for 1.5C. This additional effort to remain beneath 1.5C might be seen within the yellow wedges within the first chart, above.

(In step with the lowered prospects for gasoline on this yr’s outlook, there may be a lot much less gasoline use all through the 2022 NZE pathway than within the 2021 model. Conversely, the 2022 NZE has barely extra coal and oil use, albeit solely within the quick time period.)

Bridging the hole to 1.5C would require not solely greater ambition, but additionally a surge in clean-energy funding in what the IEA calls this “vital decade”.

Probably the most fast adjustments and the most important emissions cuts this decade want to come back from an growth of unpolluted electrical energy to displace coal.

(Determine 5.10 of the report reveals that throughout every of the IEA eventualities, round half the emissions reductions wanted to 2030 come from renewables changing coal energy.)

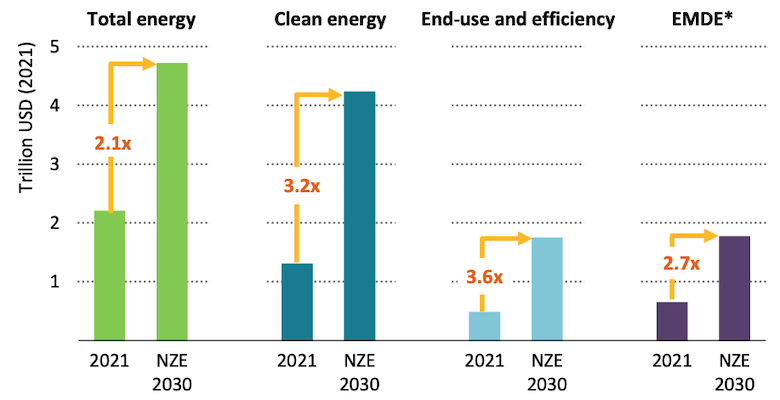

Clear-energy funding at present stands at $1.4tn per yr and must double by 2030 to satisfy present local weather pledges, or to triple to get onto the NZE 1.5C pathway.

Furthermore, this isn’t merely a query of shifting funding from “soiled” to “clear” vitality, the IEA says. Whole vitality funding must double by 2030, as proven within the determine beneath.

One key challenge highlighted by the IEA is the very giant hole between the price of clear vitality finance in developed versus creating and rising market economies.

It says the distinction within the price of capital displays “actual and perceived dangers” related to investments. The price of capital for a brand new photo voltaic plant in 2021 was between two and thrice greater in rising markets (at 9-13.5%) than in superior economies or China (2.5-5.5%).

Lowering this disparity would make a “big distinction” to the general prices of transition, it says:

“A 200 foundation level [2 percentage points] discount in the price of capital in all rising market and creating economies would cut back the cumulative clear vitality financing prices to succeed in web zero emissions by $15tn by to 2050.”

Failing to carry clear vitality funding consistent with the NZE pathway might go away the world “energy-starved”, the report warns. This may imply an unpalatable alternative between boosting fossil gasoline funding to satisfy demand and placing 1.5C in “jeopardy”. It continues:

“If clear vitality funding doesn’t speed up as within the NZE State of affairs then greater funding in oil and gasoline can be wanted to keep away from additional gasoline worth volatility, however this is able to additionally imply placing the 1.5C aim in jeopardy.”

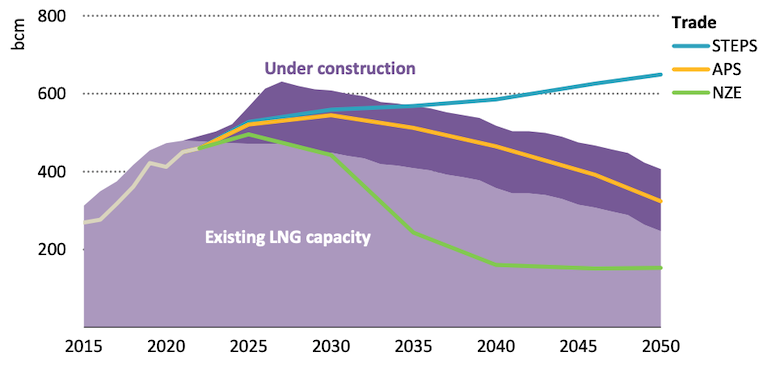

New funding in oil and gasoline provides wouldn’t solely put local weather targets in danger however would even be at business threat if demand fails to materialise, the IEA says. That is illustrated within the determine beneath for the case of liquified pure gasoline (LNG) infrastructure wanted to move gasoline by ship.

Below present insurance policies within the STEPS pathway, demand for internationally traded gasoline would rise slowly (blue line). This may imply greater demand for LNG infrastructure than what’s at present constructed (lilac space) or underneath development (purple).

Some amenities being constructed can be surplus to demand if local weather pledges are met (yellow line). And among the present capability wouldn’t be wanted underneath the 1.5C NZE pathway (inexperienced).

The IEA concludes: “lasting options to as we speak’s disaster lie in decreasing fossil gasoline demand”.

New energy-security paradigm

The worldwide vitality disaster has “stoked inflationary pressures and created a looming threat of recession”, the IEA says, in addition to rising meals insecurity.

Increased fossil gasoline costs imply that 75 million individuals who had lately gained entry to electrical energy will lose the flexibility to pay for it, the outlook says. Birol calls this a “international tragedy”.

The report provides that the transition to wash vitality may also help cut back these dangers:

“[The crisis has] underscore[d] the dangers inherent in as we speak’s vitality system and the significance of vitality safety to our economies and each day lives. Vitality transitions provide the possibility to construct a safer and extra sustainable vitality system that reduces publicity to gasoline worth volatility and brings down vitality payments, however there isn’t a assure that the journey will likely be a clean one.”

The outlook says rising geopolitical tensions and the shift to wash vitality name for what it describes as a “new vitality safety paradigm”. It units out 10 ideas for this new strategy. Birol stresses that “[u]nity and solidarity have to be the hallmarks of our response to as we speak’s disaster”.

The ten ideas are as follows:

- Synchronise scaling up of unpolluted vitality with scaling again of fossil fuels. (“Reducing funding in fossil fuels forward of scaling up funding in clear vitality pushes up costs however doesn’t essentially advance safe transitions.”)

- Sort out the vitality demand facet and enhance vitality effectivity. (“Since 2000, effectivity measures have lowered unit vitality consumption considerably, however the tempo of enchancment has slowed in recent times.”)

- Reverse the slide into vitality poverty. (“Turning these worsening vitality poverty developments round is crucial for safe, individuals‐centred vitality transitions.”)

- Convey down the price of capital in creating nations. (See above.)

- Handle the retirement of present vitality infrastructure. (“Some elements of the present fossil gasoline infrastructure carry out capabilities that can stay vital for a while, even in fast vitality transitions. They embrace gas-fired vegetation for electrical energy safety.”)

- Sort out dangers for producer economies. (“Potential export earnings from hydrogen are not any substitute for these from oil and gasoline, however low price renewables and carbon seize, storage and utilisation (CCUS) can present a sturdy supply of financial benefit.”)

- Put money into electrical energy system flexibility. (“Dependable electrical energy is central to transitions as its share in closing consumption rises from 20% as we speak to 40% within the Introduced Pledges State of affairs (APS) in 2050 and 50% within the NZE State of affairs.”)

- Diversify clear vitality provide chains. (“Mineral demand for clear vitality applied sciences is about to quadruple by 2050…Excessive and risky vital mineral costs and extremely concentrated provide chains might delay vitality transitions or make them extra pricey.”)

- Make vitality infrastructure local weather resilient. (“The rising frequency and depth of utmost climate occasions presents main dangers to the safety of vitality provides.”)

- Direct markets however don’t dismantle them. (“Governments must take the lead in making certain safe vitality transitions by tackling market distortions – notably fossil gasoline subsidies – in addition to correcting for market failures. Nevertheless, transitions are unlikely to be environment friendly if they’re managed on a top-down foundation alone.”)

On the ultimate level, the IEA notes that fossil gasoline subsidies have been on the rise. Field 4.4 of the report describes them as a “roadblock to a extra sustainable future”. It reveals that, after a big dip in 2020, fossil gasoline subsidies greater than doubled in 2021 to over $500bn. The IEA anticipates “one other sharp improve” within the subsidy determine for 2022, because of excessive vitality costs.

Sharelines from this story