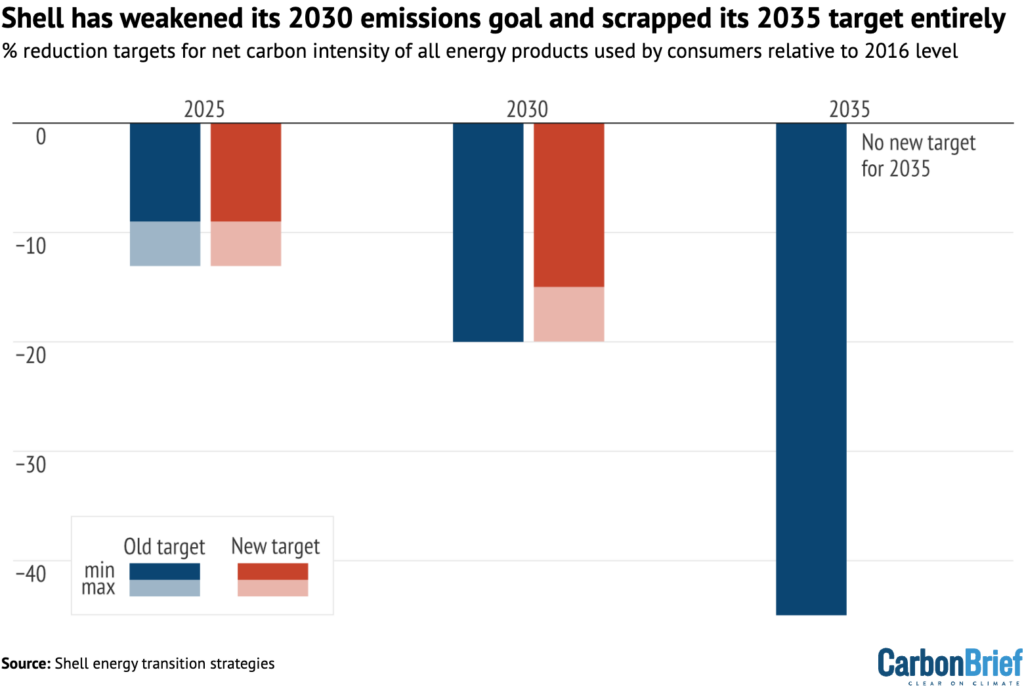

Shell has deserted a key local weather goal for 2035 and weakened one other aim for 2030, in accordance with its newest “vitality transition technique”.

The oil main has “up to date” its goal to chop the overall “web carbon depth” of all of the vitality merchandise it sells to prospects – the emissions per unit of vitality – by 20% between 2016 and 2030. The discount is now set at between 15-20%.

Inside Shell’s technique, chief govt, Wael Sawan, writes that this alteration displays “a strategic shift” to focus much less on promoting electrical energy, together with renewable energy.

As a substitute, the corporate says funding in oil and fuel “might be wanted” as a result of sustained demand for fossil fuels. It emphasises the significance of liquified pure fuel (LNG) as “vital” for the vitality transition and says it should develop its LNG enterprise by as much as 30% by 2030.

This quantities to a wager towards the world assembly its local weather objectives, with the Worldwide Power Company (IEA) and others concluding no new oil-and-gas funding is required on a pathway to 1.5C – and warning towards the danger of “overinvestment”.

Elsewhere within the report, Shell notes that it has “chosen to retire [its] 2035 goal of a forty five% discount in web carbon depth” as a result of “uncertainty within the tempo of change within the vitality transition”.

Each objectives have been meant as stepping stones on the corporate’s journey in direction of net-zero emissions by 2050, a aim set by the earlier chief govt, Ben van Beurden, in 2020.

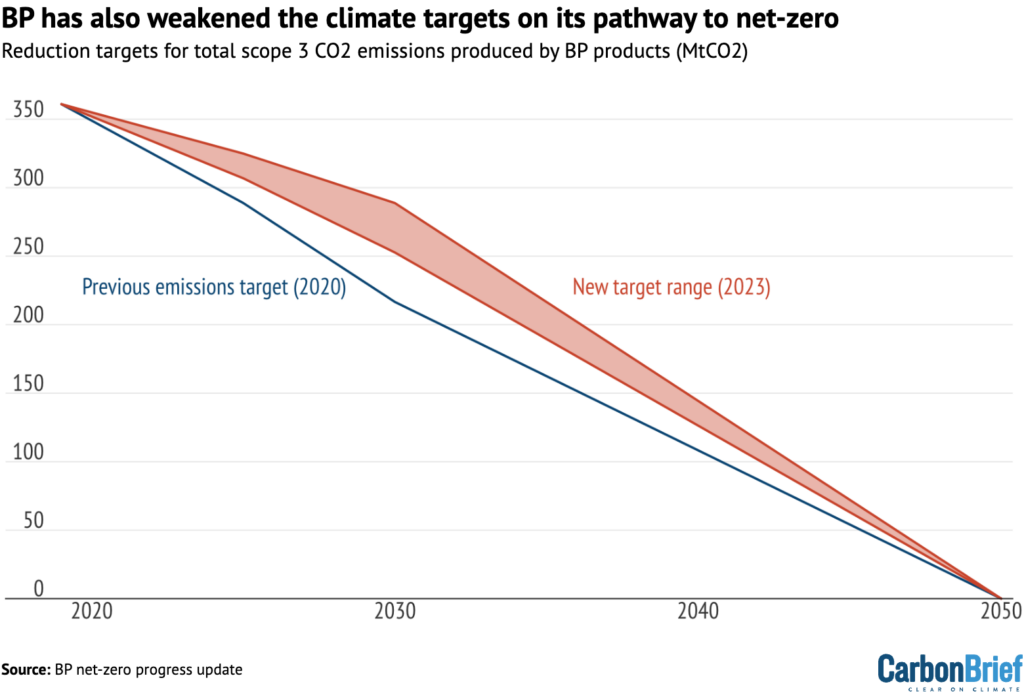

The weakening of local weather objectives from Shell, the world’s second-largest investor-owned oil-and-gas firm, comes after BP scaled again its ambitions final yr.

Weaker targets

The brand new report marks the primary three-year evaluate of Shell’s “vitality transition plan”, after it was adopted in 2021.

Slightly than setting a goal for chopping its total “scope 3” emissions – these generated by way of Shell’s fossil fuels and different vitality merchandise by customers – the corporate set itself “web carbon depth” targets on its path to net-zero.

This permits Shell to deliver down its carbon depth and hit its targets by means of means aside from chopping its oil-and-gas manufacturing, equivalent to promoting extra low-carbon merchandise, together with renewable electrical energy.

Shell initially mentioned the carbon depth of the vitality it sells would fall 20% by 2030, from a baseline of 2016, after which 45% by 2035.

This amounted to a minimize from 79g of carbon dioxide equal per megajoule of vitality (gCO2e/MJ) to 63gCO2e/MJ by 2030 and 43gCO2e/MJ by 2035.

Because the chart beneath reveals, these targets have now been weakened. The 2030 goal has been modified to a spread of 15-20% and the 2035 goal has been “retired”, in accordance with a footnote within the evaluate.

Shell attributes these adjustments to a shift in its enterprise priorities.

The agency says that on the subject of promoting electrical energy, together with renewable energy, it should concentrate on “worth over quantity”. For instance, it should goal “industrial prospects greater than retail prospects”.

The corporate factors to its withdrawal from supplying vitality to European properties, having closed its utilities arms within the UK, the Netherlands and Germany in 2023.

However, the corporate additionally says the “largest driver for decreasing our web carbon depth is growing the gross sales of and demand for low-carbon vitality”, relatively than cuts in fossil-fuels manufacturing. The report states that:

“Funding in oil and fuel might be wanted as a result of demand for oil and fuel is predicted to drop at a slower price than the pure decline price of the world’s oil and fuel fields, which is 4-5% a yr.”

This quantities to a wager towards the world assembly its carbon targets. If the world have been to get on observe to limiting warming to 1.5C, there can be no want for investments in new oil and fuel manufacturing, in accordance with the IEA.

In its 2023 World Power Outlook, the IEA mentioned that warnings from oil and fuel producers that the world was “underinvesting” in new provides have been not legitimate. It mentioned:

“[T]he fears expressed by some giant resource-holders and sure oil and fuel firms that the world is underinvesting in oil and fuel provide are not based mostly on the newest expertise and market developments.”

The company added that dangers have been “weighted extra in direction of overinvestment”.

LNG over oil

Shell has additionally launched a brand new goal for chopping emissions from buyer use of its oil merchandise, equivalent to petrol and diesel utilized in vehicles, inside its vitality transition technique evaluate.

This aim quantities to a 40% discount in absolute emissions by 2030, in comparison with 2016 – a degree the European firm says is suitable with the EU’s local weather targets for transport. Shell says it should “steadily reduc[e] publicity to grease merchandise used for transport”, by shifting its gross sales away from this space.

Alongside this, Shell introduced a renewed concentrate on LNG within the technique, which it says will play a “vital function” within the vitality transition, at the same time as individuals embrace electrical vehicles and subsequently scale back their reliance on oil.

The corporate expects world demand for LNG to proceed rising “at the least by means of the 2030s”, and says it should develop its LNG enterprise by 20-30% by 2030.

This marks a continuation of Shell’s concentrate on LNG from its 2021 technique, when it mentioned it will “prolong management” on this space.

Shell’s inside outlook for the expansion of world LNG demand is markedly extra optimistic than the IEA’s, which suggests that there’s already sufficient capability constructed or underneath development to fulfill demand for the following 20 years.

In response to the Institute for Power Economics and Monetary Evaluation (IEEFA), Shell’s LNG outlook “underestimates boundaries” to demand progress. IEEFA says:

“[Shell] is pinning its hopes on speedy demand progress in rising markets and China’s industrial sector, which can by no means materialise.”

Regardless of its plans to develop its LNG enterprise, Shell’s report general emphasises a “balanced and orderly transition away from fossil fuels”.

Wider developments

Shell states that it has thus far met its local weather targets and factors to its success decreasing emissions from its personal operations, equivalent to these from oil rigs and workplaces.

It argues within the small print on the backside of the report that, regardless of its targets for shopper carbon depth, “Shell solely controls its personal emissions”.

(Shell has lengthy maintained this line, that it’s merely assembly the demand of shoppers to purchase fossil fuels. Exxon chief govt Darren Woods just lately made a related argument.)

The report additionally stresses that its plans for net-zero are depending on society as an entire and “if society isn’t net-zero in 2050… there can be vital threat that Shell might not meet this goal”. That is acquainted language from the oil main, which steadily explains that it’s customers, not Shell itself, that affect fossil-fuel use.

Shell’s evaluate follows the worldwide vitality disaster that has unfolded over latest years, pushed by spiralling fuel costs. In response to the altering vitality panorama this has caused, there was a shift in tone from the oil majors concerning local weather commitments.

It additionally follows a interval wherein firms equivalent to Shell have made file income as a result of rising fossil-fuel costs.

After taking on from Van Beurden, Shell chief govt Sawan acknowledged that “chopping oil and fuel manufacturing isn’t wholesome”, emphasising the “fragility of the vitality system”. In his introduction to the brand new technique, Sawan writes:

“Our skill to boost and make investments capital depends upon delivering robust returns to shareholders, shaping the function that Shell can play on the journey to net-zero. We imagine this focus makes it extra, not much less, doubtless that we’ll obtain our local weather targets and ambitions.”

BP, Europe’s second largest oil main, weakened its local weather targets final yr. The change in its objectives, which not like Shell’s are based mostly on full scope 3 emissions, might be seen within the chart beneath.

Shell’s “strategic shift” in its operational focus comes amid a wider effort to chop working prices.

This has seen the corporate announce plans to scale back employees numbers, particularly in low-carbon sectors of the corporate equivalent to hydrogen.

The corporate’s income have fallen now fossil-fuel prices have returned to extra regular ranges, however have remained excessive. In February, the corporate introduced an annual revenue for 2023 of greater than £22bn ($28bn), one among its most worthwhile years on file.

Sharelines from this story