Photo voltaic and wind capability within the Affiliation of Southeast Asian Nations (ASEAN) area elevated by 20% in 2023, bringing the entire to greater than 28 gigawatts (GW).

The applied sciences now make up 9% of electrical energy producing capability in ASEAN nations – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam – based on a brand new report from International Vitality Monitor (GEM).

Mixed with a big base of hydropower, the expansion in wind and photo voltaic takes the bloc near its renewable power capability goal of 35% by 2025, GEM says.

Constructing a further 17GW of utility-scale photo voltaic and wind initiatives within the subsequent two years – people who feed energy instantly into the electrical energy grid – could be adequate to succeed in the objective, it provides.

Actually, it says the area is on observe to sail previous its goal, almost doubling wind and photo voltaic capability within the subsequent two years by including an extra 23GW of recent initiatives

A good bigger 220GW pipeline of recent utility-scale wind and photo voltaic capability has been introduced, or entered pre-construction or development phases, based on GEM’s evaluation, although solely 6GW of that is at present being constructed.

Nevertheless, ASEAN nations collectively have one of many fastest-growing economies on this planet and have seen very speedy latest electrical energy demand development of twenty-two% per yr between 2015 and 2021. This has translated into continued help for gasoline and coal energy within the area, although demand development is predicted to gradual.

Whereas renewables have the potential to mood the expansion in fossil gas demand, wind and photo voltaic growth face regulatory hurdles and a scarcity of supportive coverage, GEM provides.

Success thus far

ASEAN added 3GW of photo voltaic capability in 2023, rising put in capability by 17% over 2022 ranges, based on GEM’s report.

Regardless of photo voltaic seeing a bigger total capability improve, operational wind capability noticed a bigger comparative rise, rising by 29%, or 2GW, since January 2023.

Offshore wind now accounts for 2GW of the working 9GW of utility-scale wind capability within the area.

Given the technical challenges and related larger prices of offshore wind, that is notably noteworthy, GEM states.

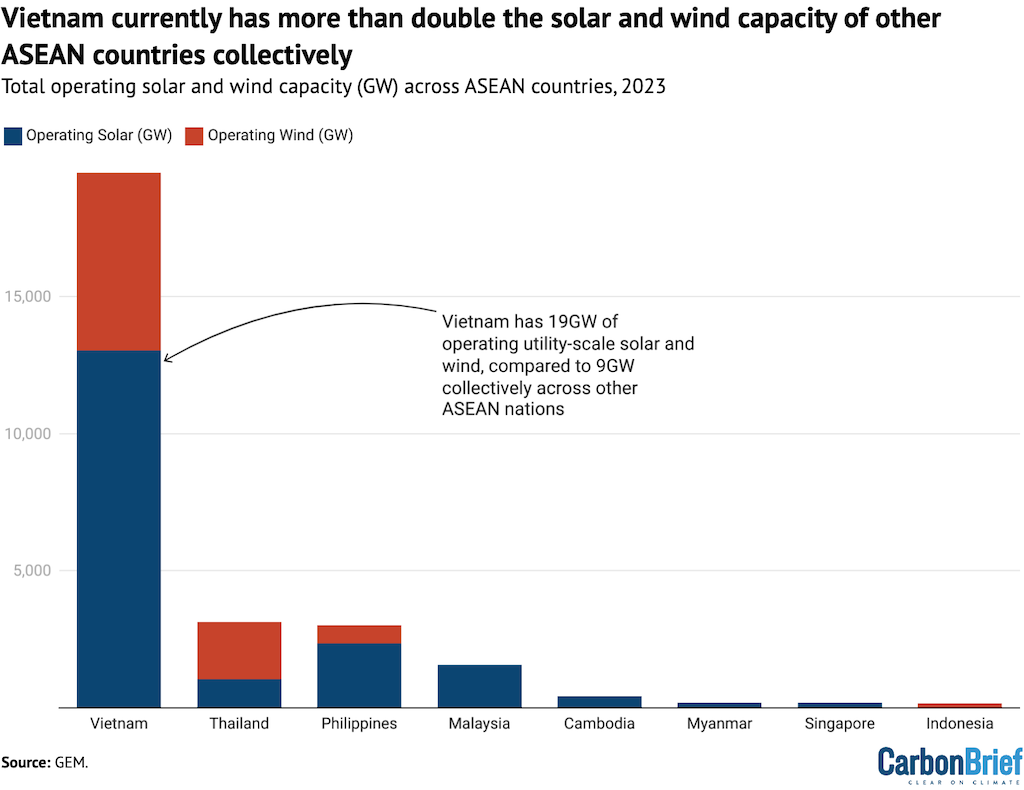

Vietnam has by far probably the most utility-scale photo voltaic and wind capability of all of the ASEAN nations, as seen within the chart beneath.

The rise in utility-scale photo voltaic and wind capability over the previous yr has come because of a supportive coverage atmosphere throughout many nations within the ASEAN area, says GEM.

In 2017, Vietnam deployed a sequence of funding insurance policies designed to deliver utility scale-solar initiatives into operation, for instance. Two feed-in-tariff (FiT) packages had been deployed by the nation’s state-owned utility between 2017 and 2020.

Nevertheless, when these packages expired, Vietnam did not administer a alternative, GEM says. As such, regardless of the nation including 12GW of utility-scale photo voltaic capability between 2019 and 2021, gaps in power coverage have began to restrict progress.

Simply 1GW of utility-scale photo voltaic and wind was commissioned in Vietnam in 2022, as compared with almost 4GW in 2021.

Thailand and the Philippines at present have the second and third highest utility-scale photo voltaic and wind capability within the area, with 3GW of working capability every.

Thailand is the second largest economic system in ASEAN after Indonesia and has benefitted from being seen as a “low-risk nation”, notes GEM, with few limitations for funding.

The Philippines, in the meantime, hosts a “streamlined challenge bidding system”, which permits for an “unencumbered pipeline of challenge improvement”, GEM says. Presently, round three-quarters of its operational utility-scale photo voltaic and wind capability comes from photo voltaic.

Future development

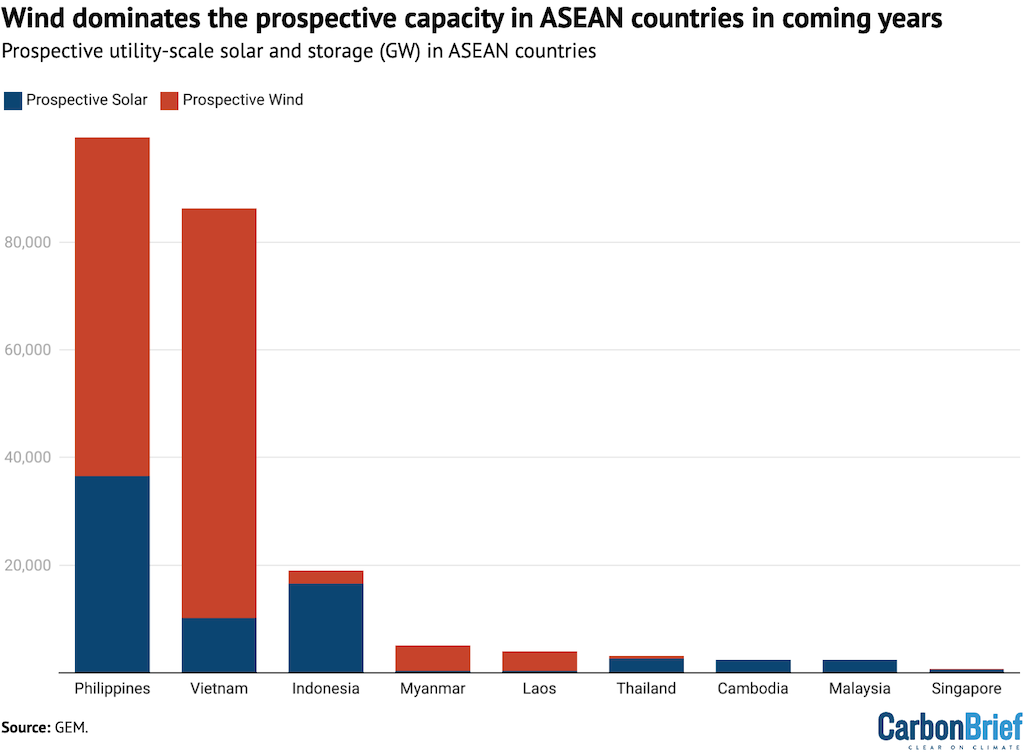

There’s at present a complete of 222GW of introduced, pre-construction and construction-stage utility-scale wind and photo voltaic capability in ASEAN nations, based on GEM’s analysis.

Greater than 185GW of this pipeline of initiatives is within the Philippines and Vietnam, which means they account for greater than 80% of potential capability within the area. That is proven within the determine beneath.

Greater than 60% of the pipeline in Vietnam and the Philippines comes from deliberate offshore wind improvement, GEM says, of 72GW and 52GW respectively.

The Philippines is accountable for 45% of potential capability in ASEAN nations. Its Inexperienced Vitality Public sale Program (GEAP) goals to facilitate the event of greater than 11GW of renewable power.

In March 2023, it held an public sale securing simply over 300 bids to develop 3GW of photo voltaic, onshore wind and bioenergy with 2024–2026 begin dates.

This capability fell in need of the extent focused, however represented a 75% improve on the quantity secured in 2022’s public sale, notes GEM.

Offshore wind includes 52% of the Philippines’ potential utility-scale renewable capability, with 5 instances extra offshore wind than onshore.

In April 2023, the nation issued an government order, outlining cooperation between non-public traders and the federal government on offshore wind. Since then, offshore wind contracts have greater than doubled to almost 80, representing 61GW of capability, GEM notes.

Vietnam has greater than 86GW of potential capability, together with 72GW of offshore wind. Nevertheless, simply 2% is at present being constructed, due partially to the nation’s “lack of concise and dependable renewable power insurance policies that might function an important roadmap for challenge implementation”, states GEM.

An extra 40GW of utility-scale photo voltaic and wind initiatives in Vietnam are thought of by GEM to be “shelved”, as a result of they’ve seen no development or bulletins up to now two years.

Vietnam is engaged on a simply power transition partnership (JETP) with a gaggle of developed nations. It additionally launched its newest nationwide electrical energy improvement plan for 2021–2030, often known as the energy improvement plan 8 (PDP8).

The alignment of those insurance policies and funding schemes remains to be in improvement, and due to this fact their impression can’t but be decided, notes GEM.

Laos is aiming to “punch above its financial weight” within the improvement of utility-scale photo voltaic and wind capability, GEM says. At greater than 3GW, its potential capability rivals that of Thailand, regardless of the nation’s economic system being solely 2% of the scale.

Laos’ potential utility-scale photo voltaic and wind capability surpasses that of Malaysia by greater than 150%, regardless of having an economic system that’s greater than thirty instances smaller. This ambition is being pushed by monetary collaboration with ASEAN companions, based on GEM.

Laos is ready to deal with the area’s largest onshore windfarm. Monsoon windfarm is at present beneath development and anticipated to have a capability of 600 megawatts (MW) when full.

Regardless of this massive pipeline of ASEAN wind and photo voltaic initiatives, nonetheless, solely 6.3GW (3%) is at present beneath development, notes GEM.

Reaching renewable ambitions

The goal for renewables to make up 35% of electrical energy producing capability by 2025 is “simply attainable and finally unambitious for ASEAN”, based on GEM.

Renewables already make up 32% of electrical energy capability in ASEAN nations, GEM says, which means the 35% goal might be met simply.

Furthermore, whereas annual development in electrical energy consumption is predicted to gradual from the annual 22% since 2014 to simply 3% a yr out to 2030, GEM says rising demand will proceed to drive growth in fossil gas energy infrastructure within the area.

Hitting the 35% goal would solely require ASEAN nations to fee 17GW of recent renewable capability by 2025, GEM says, of which 6.3GW is already beneath development.

But there may be in extra of 220GW of potential utility-scale photo voltaic and wind in improvement, with a complete of 23GW set to be operational by 2025.

This implies the area is on observe to beat its goal and almost double its put in wind and photo voltaic capability in simply two years, based on GEM, with scope to go even additional and scale back the necessity for fossil gas growth.

For now, fossil fuels stay entrenched within the area, limiting new funding in utility-scale wind and photo voltaic, GEM states.

Gasoline and coal every account for about 30% of ASEAN nations’ complete put in capability, and coal-fired energy capability has seen an annual development fee of seven% since 2017.

With electrical energy demand development at present outpacing the rollout of renewable power capability, gasoline and coal are anticipated to proceed to develop in coming years, GEM says.

Nationwide power insurance policies have touted using gasoline as a “stepping stone” within the power transition and ASEAN nations are prone to be web importers of gasoline by 2025.

Inadequate grid infrastructure funding can also be a “persistent hurdle” for integrating utility-scale photo voltaic and wind, notes GEM.

As such, whereas there’s a clear effort being made to ramp up renewable power, this continues to be sophisticated by a buildout of fossil fuels and low photo voltaic and wind development charges, concludes GEM. The report provides:

“By doubling down on bringing as a lot of the 220GW of potential utility-scale photo voltaic and wind initiatives into fruition, ASEAN nations will likely be poised to not solely meet regional renewable power targets, however pave the way in which to transition from fossil fuels.”

Sharelines from this story